A loan for starting and developing a business - how to get a loan for a small business from scratch and where loans are issued to small businesses without collateral: TOP-3 banks

Hello dear readers of the Rich Pro business magazine! In this article we will tell you how to get a loan for starting and developing a small business from scratch and where you can get an unsecured loan for your business.

It's no secret that creating and developing your own business requires a lot of money. But far from always, entrepreneurs have a sufficient amount of funds. Most of them have to be content with what they have.

However, a way out can always be found. With insufficient funds, it can become loan for business. This topic is dedicated to our publication today.

After reading the article from beginning to end, you will learn:

- What are the features of lending to small and medium-sized businesses;

- What you need to get a loan to start a business from scratch;

- What are the steps necessary to get a loan for the development of small businesses.

At the end of the article we will try to answer the most popular questions about business loans.

The presented publication will be useful to those entrepreneurs who plan to get a business loan. It will not be superfluous to carefully read the article to those who are fond of finance. As they say, time is money. Therefore, do not lose it, start reading right now!

About what loans for opening / developing a business are, how to get a loan for small and medium-sized businesses from scratch and where you can get a loan for business purposes without collateral - read in this issue

About what loans for opening / developing a business are, how to get a loan for small and medium-sized businesses from scratch and where you can get a loan for business purposes without collateral - read in this issue

1. Loans to small and medium-sized businesses - opening and development of their business using borrowed funds

It is not easy to get a loan for business development. It is even more difficult to get money for opening a small or medium business.

Important to understand that most banks are distrustful of entrepreneurs and newly created companies. This is especially true for those businessmen who cannot provide serious evidence of their own solvency.

It’s quite possible to understand lenders. The Bank is not a charity, so it is important for him to be sure that the money issued on credit will be returned in a timely manner. The easiest way to get a loan is for those businessmen who have long and successfully been operating.

There are several ways to get business loan. However, for their registration, the borrower must meet certain criteria. Often, the conditions for beginning businessmen are quite stringent. All of them are designed to guarantee the bank timely repayment of debt.

Credit organizations offer small businesses a large number of different programs. However, most of them do not want to cooperate with entrepreneurs and individuals. Starting a business from scratch always involves high risks. Lenders are unwilling to accept them.

Often created business projects are unprofitable. If this happens, there will be no one to repay the debts.

Banks providing loans for small businesses often take the following measures to reduce their own risks:

- the requirement of additional security in the form of a surety or pledge;

- registration of an insurance policy;

- loan rate increase;

- require a detailed business plan if you wish to open a new business;

- develop loan programs with a large number of additional restrictions and conditions;

- a thorough study of information about the future borrower.

If a business has been operating for several years, getting a loan will be easier.

There are special credit programs with state support, which are designed for those who conduct business in an area beneficial to the government.

for exampleThere are programs to create production in the Far East or the Far North.

If a beginner businessman doesn’t have a small amount to start an activity, it’s often easier and more profitable inappropriate consumer loan. In this case, you will have to prove your solvency as an individual.

If you want to get a loan for a business, a credit institution without fail clarifies the purpose of obtaining funds.

Most often, the following business tasks act as a loan objective:

- working capital increase;

- purchase of additional or advanced equipment;

- acquisition of patents, as well as licenses.

By no means for all purposes are banks willing to give out loans. They prefer to issue loans exclusively for financially promising tasks.

The loan repayment period is determined individually depending on the tasks that are supposed to be solved using the money received:

- If the purpose of obtaining a loan is to increase working capital, the repayment period is usually does not exceed 1 year;

- If a loan is issued for the purchase of equipment or the opening of new branches, a loan is usually allocated from 3 to 5 years.

Beginner businessmen should be prepared that they may need to provide pledge. As collateral usually used liquid expensive property.

Most often, banks accept as collateral:

- the property;

- means of transport;

- equipment;

- securities.

Other property that is in demand in the market may be provided as collateral.

In addition to the availability of high-quality collateral, banks take into account the following criteria:

- Availability of quality credit history. It is unlikely that malicious violators of credit agreements will get a large loan;

- Financial indicators are taken into account when applying for loans by existing organizations;

- Availability and quality of business reputation;

- The place that the company occupies in the market, as well as its position in the industry;

- The quantity and quality of fixed assets. Other components of the material and technical base of the business are also considered.

All of the above requirements significantly complicate the design of a loan for companies and entrepreneurs.

Far from always, businessmen manage to independently choose a suitable loan program and cope with all the requirements of the bank. If this situation occurs, it makes sense to turn to credit brokers.

These companies help in obtaining loans. But you should be as careful as possible and not transfer funds before the loan is issued. Among brokers there are many scammers.

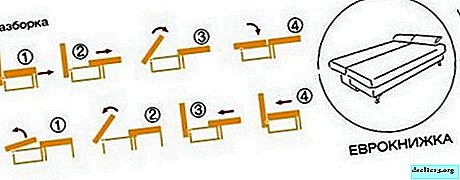

Popular types of loans for small and medium businesses

Popular types of loans for small and medium businesses

2. What are the loans for business - 5 main types of loans

Choosing a loan type for small and medium-sized businesses should be based on the unique characteristics of a particular activity.

It’s important to consider that there are a number of cases where it is more advisable for novice businessmen to use consumer programs of inappropriate lending to individuals. Having issued such a loan, citizens have the right to spend the funds received at their discretion.

Do not forget that there are several types of business loans. The most popular are described below.

Type 1. Traditional loan

Classic business loans are issued for the following purposes:

- if you want to work for yourself and start your own business;

- on the development of existing business;

- for increasing working capital;

- for the acquisition of equipment and other fixed assets.

For targeted loans intended for the implementation of certain business tasks, the rate in most cases is approximately 1.5-3% below. It is determined by the selected lender, as well as the program.

The average market rate is about 15%. In most cases, when providing security, it can be significantly reduced. The size of a traditional business loan is determined borrower objectivesas well as the selected the program. The range can be very large.

Banks offer both small loans totaling only a few million, and large loans amounting to several tens of millions. At the same time, the entrepreneur will be able to take a smaller amount than medium and large enterprises.

Type 2. Overdraft

This loan can be obtained at the bank by the owners of card and settlement accounts. Most often, overdraft is used by medium and large organizations.

Overdraft - This is a type of lending that provides the borrower with the opportunity to withdraw money from the account in an amount exceeding its balance. For the use of funds over the funds placed on the account, its owner is forced to pay interest.

This service allows companies to eliminate cash gaps. They represent situations when the money on the account belonging to the organization is not enough to fulfill current financial obligations. After receipt of funds from debtors to the borrower's account, they go to repay the resulting debt.

The overdraft interest rate is determined by a huge number of criteria:

- size of turns on the account;

- the degree of trust of the bank to the borrower;

- term of service in a specific credit institution, etc.

The average market rate varies between from 12 to 18% per annum. An important feature of the overdraft is the absence of the need to provide collateral in the form of collateral or guarantors.

Type 3. Credit line

Credit line It is a loan issued not immediately in full, but in small installments. In this case, the businessman takes the money at regular intervals.

The credit line is convenient for the client in that he can use only that part of the loan that he needs at the moment. In this case, the cost of the loan will be optimized, since interest is calculated only on the basis of current debt.

An important concept when studying the issue of a credit line is tranche. It represents a part of funds that is issued at a time.

An important condition is that the total amount of debt at any time should not exceed the total limit of the credit line.

In accordance with the agreement, tranches can be provided to the client at regular intervals or as necessary. In the latter case, the borrower must write an application for a part of the loan.

Type 4. Bank guarantee

In fact, bank guarantee Credit can only be called a stretch.

It is much more accurate to talk about it as a type of guarantee, as well as a type of insurance for default risks. If such a situation occurs, the customer’s expenses will be compensated by a bank guarantee.

Most often it is applied in the field of public procurement, as well as tenders. Here, the guarantee acts as ensuring the fulfillment of obligations under concluded state contracts.

It is important to carefully study the basic concepts, as well as the principles of the bank guarantee.

3 parties are involved in the transaction in question:

- The guarantor of the transaction is most often the bank. It is he who assumes the performance of obligations in case of violation of the terms of the contract;

- Principal - contractor. A bank guarantee is in case of default by this person;

- Beneficiary - the customer under the contract. He must be sure that the agreement will be fully implemented.

Knowing which parties are involved in concluding a bank guarantee, it is easy to understand the mechanism of its action:

- The beneficiary and the principal enter into a contract. The customer (beneficiary) at the same time demands to guarantee that it will be executed in a timely manner and in full. Such confidence is especially important when concluding government contracts, as well as orders for large volumes of work or the delivery of large quantities of goods.

- In order to prove its reliability, as well as insure risks, the contractor provides the customer with a guarantee on the amount of the contract. If for some reason he fails to fulfill his obligations, the bank will pay the customer cash.

However, the bank will not remain at a loss. For receiving a bank guarantee, the principal pays a guarantee to a certain commission. Moreover, after payment of funds to the beneficiary, the guarantor has the right to claim this amount from the principal.

Type 5. Specific loans

In addition to the types of loans discussed above, there are specific types of loans for businesses. These usually include factoring and leasing.

1) Factoring

Factoring is similarity of a commodity loan, which is provided to the business by banks or specialized companies.

The factoring scheme looks simple:

- The buyer receives from the seller the goods necessary for doing business (eg, raw materials and equipment).

- A credit institution (bank or factoring company) pays the invoice for the buyer.

- Subsequently, the lender gradually receives the money back from the buyer.

The benefits of factoring are obvious for all 3 parties:

- Buyer can purchase the goods he needs without waiting for a sufficient amount to be accumulated.

- Seller immediately receives funds without having to provide an installment plan.

- Bank or factoring company for the provision of funds receive income in the form percent. In some cases, the rate under the factoring agreement is not provided. In this case, the seller makes the bank a discount on the price. The creditor receives from the buyer the cost of the goods in full.

Keep in mind that factoring refers to short-term loans. It will have to be returned much faster than traditional loans. Usually the contractual term does not exceed six months.

It is far from always that the buyer knows that the right to claim debt from him has been assigned to a third party. He may think that the goods were provided to him in installments by a store. In this case, talk about closed factoring. If the counterparties act openly (agreed on all terms of the transaction), there is open factoring.

2) Leasing

Leasing is called differently finance lease. It involves the provision of various property (eg, equipment or vehicles) for use by the client.

Modern banks have subsidiaries that lend business assets instead of money to businessmen.

For newly opened companies, leasing may be the best opportunity to start using expensive equipment. But it’s worth considering that it will be issued not for ownership, but for rent. It acts foreclosure right at the end of the contract.

There are a number of advantages of leasing:

- interest, which determine the cost of the loan, is significantly lower than on a traditional loan;

- high speed of registration;

- minimum package of necessary documents;

- lack of need to provide business plans, as well as economic justifications;

- loyal requirements to potential customers.

Leasing and factoring are very convenient lending tools. But do not forget that they are designed to solve too narrow, specifically set business tasks.

It is important to carefully study all available types of lending. Detailed analysis only the benefits and newealth, as well as the possibilities of using each of them in a specific situation, allows you to make the right choice.

What banks look at when applying for a small business loan

What banks look at when applying for a small business loan

3. 4 main conditions for obtaining a loan for the opening and development of small businesses

To start any entrepreneurial activity, it is not enough to have only a desire and a development strategy; considerable funds are also required. However, obtaining a loan for such purposes can be difficult.

Banks carefully check each client. The potential borrower must meet the rather strict requirements of the lender, as well as the conditions of the selected loan program.

Nevertheless, you can increase the chance of approval of the application. It is enough to observe certain conditions, the main of which are described below.

Condition 1. Providing the most complete package of documents

It is impossible to get a loan without providing the bank with the documents included in its list.

The borrower must understand the more complete a package of documents he manages to collect, the greater the probability of acceptance positive decision by application.

It is important that all documents are current on the date they are submitted. If necessary, do copies.

However, it’s worth going to the bank along with the originals, because the employee will reconcile them. If for some reason the originals cannot be submitted, you will have to notarize the copies made.

It is also necessary to clarify whether licenses and patents to carry out the selected type of activity. If you arrange them in advance, the chance to get a loan to open a business will increase significantly.

Condition 2. Providing Collateral

For the bank, collateral acts as an additional guarantee for the repayment of funds issued on credit. However, the benefits of such loans are obvious not only to lenders, but also to the borrowers themselves.

If you have collateral, you can count on more favorable credit conditions:

- Bets such loans are traditionally lower;

- Return period longer

- Borrower Requirements more loyal.

Traditionally, there are 2 types of collateral:

- pledge;

- surety.

As collateral may be:

- residential and non-residential real estate;

- plots of land;

- means of transport;

- equipment in demand and in good condition;

- liquid securities.

A pledge may also be other liquid property that the bank is comfortable with.

Another type of collateral - surety also greatly increases the chance of a positive decision. As guarantors can act as physicaland legal entities.

A guarantee may also be accepted from:

- urban as well as regional centers of entrepreneurship;

- business incubators;

- other structures whose purpose is to support business at the initial stage of development.

Condition 3. Good credit standing.

In the process of making a decision on granting a loan, the Bank necessarily checks the reputation of a potential borrower. If the application is filed for a business loan, this procedure is aimed at company executives as well as entrepreneurs.

The quality of credit reputation is formed taking into account the following factors:

- successful and timely return of previously received loans;

- lack of delays in previously executed loan agreements;

- All previously issued loans are returned.

Important to understand not always banks believe that the lack of a credit history is better than a damaged reputation. In the first case, the bank cannot predict what to expect from the borrower.At the same time, a damaged credit history in some cases arises for a good reason.

By the way, today some banks and microfinance organizations offer a service to correct credit history. Of course, this procedure is quite lengthy. You will have to arrange some of the maximum possible loans and return them in time.

Condition 4. Availability of a high-quality detailed business plan for obtaining a loan

A business plan is an important document for the process of becoming an activity. This document is important not only for the bank, but also for the businessman himself.

Experts say that without understanding the basics of designing a business plan, it makes no sense to start your own business. Read on our website detailed material on the preparation of a business plan.

Properly and professionally written document helps to determine the future business development strategy. Without it, it is difficult to determine what the costs and revenues will be, which means whether the business will be profitable.

It is a business plan that reflects how it is planned to use the money received on credit from the bank.

But do not forget that the business plan is a document consisting of several tens of pages. Naturally, the bank employees do not have enough time to study such a document. Therefore, to obtain a loan provide a brief version of it, which contains no more than 10 pages.

By strictly observing the conditions described above, the borrower can significantly increase the likelihood of a positive decision on the loan application.

We also advise you to read our article on how to get a loan for entrepreneurs to start a business.

4. What are the features of small business loans without collateral and guarantors - important nuances of unsecured loans 🗒

In the struggle for customers, banks often simplify credit conditions. Today, a business loan can be issued from scratch without collateral and guarantors.

Unsecured loans for small businesses

Unsecured loans for small businesses

Such loans are traditionally used to solve various problems:

- refinancing of a previously issued loan;

- working capital increase;

- acquisition of fixed assets;

- repayment of accounts payable.

It is important to carefully study all the features of small business lending without collateral and guarantors.

It is worth paying attention to the benefits of unsecured loans for small businesses:

- high speed of registration, and hence the receipt of money;

- drawing up an individual repayment schedule, which will take into account the features of the activity;

- the ability to receive funds in a form convenient for a businessman - in cash, in currency, by bank transfer at the specified details.

It is important to keep in mind that the bank carefully examines the documents submitted before issuing a loan. This process takes place individually for each case. During the analysis, bank employees seek to evaluate borrower solvencyto get a guarantee of the return of loans.

When applying for a loan without providing collateral, a guarantee of debt repayment is:

- borrower reputation;

- business development prospects;

- the size of the planned profit.

It turns out that one side the procedure for obtaining a loan without providing security is greatly simplified.

However on the other hand, the probability of a positive decision on the application is significantly reduced. This is especially true of the newly created or planned to open a business.

The increase in the number of failures is simply explained - for the lender, the risk of default upon the issuance of funds to novice entrepreneurs increases significantly⇑.

That is why when developing programs for issuing loans to businesses without the use of collateral, lenders in most cases substantially tighten their terms.

Loans for businesses without collateral and guarantors are characterized by the following parameters:

- Minimum return deadlines- it will be necessary to fulfill obligations under the contract very quickly;

- Limited loan amount - it is unlikely to receive a sufficiently large amount without providing additional guarantees in the form of security. In most cases, it is possible to obtain without collateral and guarantors no more 1 one million rubles;

- Bid increase compared to secured and surety loans. Often they reach 25% APR.

Naturally, such conditions are disadvantageous for entrepreneurs. Often businessmen make a decision in such a situation to turn to credit brokerswho promise to choose the most favorable conditions.

But do not forget that in the field of brokerage organizations there are many scammers. Therefore, payment for their services should be made only after issuing a loan.

By providing unsecured loans, banks run the risk of not only not receiving the planned income, but also of losing their funds. That is why they tighten credit conditions. As a result, many businessmen refuse to issue a loan without collateral.

In most cases, novice businessmen still have to decide on secured loan. They draw up loans on bail and surety. There are several reasons for this: more loyal requirements for the borrower himself, less stringent conditions for the provision of money, etc.

However, in this case, the registration procedure is complicated, because you will have to submit additional documents confirming the ownership of the pledged item. If you plan to borrow money under the guarantee of third parties, you will have to prepare his documents.

The main stages of obtaining a loan for opening / development of a small business

The main stages of obtaining a loan for opening / development of a small business

5. How to get / take a loan for starting and developing a small business from scratch - 7 main stages of registration

Making a loan for a business is not an easy task. First of all, you have to familiarize yourself with the requirements of banks to applicants:

- the presence of a stable profit over a certain period of time;

- drawing up a quality business plan;

- the possession of liquid expensive property;

- net credit standing;

- finding a business within the territory of the banking product;

- opening a current account in a bank for loan processing.

The presented list is far from complete. Each credit organization independently develops loan conditions.

Take note! Banks always have a negative attitude towards businessmen who have had bad experience in organizing their own business in the past.

At the same time, the successful conduct of business over a long period can be a significant plus when applying for a loan.

The reason for the rejection of the loan application may be:

- seizure of property owned by business and management;

- arrears of tax and other payments;

- open court cases in which the applicant takes part.

It turns out that the process of obtaining a loan is a rather complicated procedure. To make it easier for yourself, beginners should carefully study the following instructioncompiled by professionals.

The exact implementation of the steps described below allows you to increase the likelihood of a positive decision on the application, as well as to avoid a huge number of popular errors.

Stage 1. Preparation of a business plan

Very few lenders decide to provide a loan to entrepreneurs and companies without familiarizing themselves with business plan. This is characteristic not only for the created organizations, but also for the development of existing ones.

Business plan - This is a document that defines the strategy and tactics of further business development.

To compile it, several types of analysis are carried out - production, financial, as well as technological. At the same time, the characteristics of not only the current activities of the company, but also the future results of the project are studied.

It is important to calculate all the income and expenses arising in the course of its implementation, as well as an increase in production volumes. The business plan is intended to demonstrate to the creditor where exactly his money will be directed..

Properly and professionally written document includes a huge number of pages. Naturally, when studying a loan application, bank employees do not have enough time to study a full business plan.

Therefore, for these purposes, it will be necessary to additionally draw up a shortened version of the document, which contains no more than 10 pages.

Stage 2. Choosing a direction of development

Recently, a popular way to develop or organize a business has become the use of franchises. It is a ready-made model for building activities, which is provided to the entrepreneur by a well-known brand that has already become quite popular. More information about franchises and franchising in our special publication.

Franchise can substantially raise the chances of application approval. Banks are more loyal to projects based on its principles, because the probability of success in this case is higher.

At the same time, when deciding to open their own, unknown business, lenders are skeptical about the submitted application. In such a situation, no one can guarantee success.

The presence of a licensed franchise agreement fundamentally changes the matter. It should be borne in mind that most companies that provide their brand for use are partners of a particular credit institution. It is to her that she should apply for a loan.

Stage 3. Registration of activity

Any organization must be properly registered with state bodies. If the company is just opening, you will have to go through this procedure.

First of all should choose the optimal taxation system. To do this, you will have to study a significant amount of relevant information or contact a professional accountant.

After that, you will have to go to the tax office with the relevant documents. At the end of the company registration procedure, the entrepreneur is issued the appropriate certificate.

Stage 4. Choosing a bank

Choosing a credit institution is the most important step towards obtaining a loan. The number of banks that give money to create and develop a business is a huge amount. Most of them offer several programs that have their own conditions and features.

In such a situation, choosing a bank is not easy. You can alleviate the problem by evaluating credit organizations according to a number of characteristics offered by specialists.

The criteria for choosing a bank for a business loan are as follows:

- the length of the period of activity in the financial market;

- offering several programs at once suitable for various categories of borrowers;

- reviews of real customers who have used the services of the bank in question;

- terms and conditions of a credit institution's proposals - rate, availability and size of various commissions, term and amount of the loan.

Professionals recommend to issue loans in major major banks. It is important that branches and ATMs were located within walking distance for the borrower. Equally important is availability and effectiveness. online banking.

Step 5. Choosing a program and applying

When the bank is selected, you can begin to analyze the programs it offers. It should be borne in mind that they may differ not only in conditions, but also in requirements for the borrower or collateral.

When the program is selected, it remains to submit application. Today it’s not necessary to go to the bank’s office. Most credit organizations offer to send it in mode online. It is enough to fill out a short form on the site and press the button "Send".

After consideration of the application by the bank employees, the client receives preliminary decision. If approved, it will remain with the documents to visit the bank branch.

After a conversation with the applicant and consideration of the original documents will be accepted final decision.

The convenience of applying online is the ability to contact several banks at once. In this case, you can save a lot of time.

In case of refusal in one bank worth the wait for another answer.

If approval is obtained from several lenders, It remains to choose the most suitable among them.

Stage 6. Preparation of a package of documents

In fact, experts advise in advance prepare the necessary documents, especially those that require everywhere. Of course, each lender independently draws up an appropriate list. However, there is a standard list of documents.

The package always includes 2 groups of documents:

- Entrepreneur documents, as well as the guarantor as an individual. These include passport, second documentidentity card. In some cases also required income statement.

- Documents for business - constituent, business plan, balance sheet or other financial documents. Subject to availability franchising agreement. If a deposit is made, you will have to submit ownership documents on the relevant property.

The more documents a prospective borrower can collect, the higher the likelihood of a positive decision.

Stage 7. Down payment and borrowing

Often, business loans are issued only on condition of making down payment. This primarily concerns loans for the purchase of real estate, vehicles and expensive equipment.

In this step, if necessary make a down payment and get relevant supporting documents.

For self-calculation of a loan, we suggest using a loan calculator:

Further carried out signing a loan agreement. It would be useful to once again recall the need to carefully read the agreement before signing it.

When the contract is signed, the borrower will receive credit funds for the business. In most cases, money is credited directly to payment account the borrower. However, when obtaining a loan to purchase equipment, real estate or vehicles, money is transferred directly to the seller.

If you strictly follow the instructions above, you can avoid a lot of problems. In addition, you can significantly speed up the process of registration.

6. Where to get a loan for business - TOP-3 of the best banks with favorable credit conditions

You can get a business loan in a large number of banks. Making a choice is often difficult. Can help descriptions of the best banksmade by professionals.

So, we will consider which banks provide affordable and profitable loans to small businesses.

1) Sberbank

Sberbank is the most popular Russian bank. Several programs for lending to a business have been developed here.

Sberbank is the most popular Russian bank. Several programs for lending to a business have been developed here.

Statistics confirm that about 50% of adult Russians are clients of this credit institution. In this situation, many businessmen (especially at the beginning of their activities) primarily try to get a loan here.

Experts advise first of all pay attention to the program conditions "The trust". It is designed to meet the needs of small as well as medium-sized businesses.

In accordance with this program without security you can get up to 3 million rubles. This can be done not only by companies, but also by individual entrepreneurs. Interest rate from16,5% APR.

Sberbank has other programs:

- express loan for business;

- business asset;

- working capital replenishment;

- for the purchase of vehicles, as well as equipment;

- business invest;

- factoring;

- leasing.

In the office of Sberbank, traditionally large lines. However, to apply for any business loan, just visit its website. Having filled out a questionnaire there, you will have to wait about 2-3 of the day.

2) Raiffeisenbank

For those who are not able to provide a business plan, guarantors or property as collateral, the bank offers to issue consumer credit.

For those who are not able to provide a business plan, guarantors or property as collateral, the bank offers to issue consumer credit.

For entrepreneurs who wish to arrange a special loan for a company or individual entrepreneur, several programs have been developed here:

- overdraft - conditions are considered individually;

- express - allows you to quickly get before 2million rubles;

- classic - a program by which it will be possible to occupy before 4,5 million rubles.

To choose the best loan for a business, just call the bank. Employees will advise and help you understand all the intricacies of existing programs.

3) VTB Bank of Moscow

Special loans have been developed here for both existing and just opening small business companies.

Special loans have been developed here for both existing and just opening small business companies.

The most popular programs include:

- for working capital - Turnover program;

- for using money in excess of the balance in the current account - Overdraft;

- for the purchase of equipment, as well as for the expansion of existing production - Business perspective.

You can also get traditional consumer credit as an individual (business owner). Moreover, the amount can reach 3million rubles.

If the business has enough funds offered under this program, it makes sense to think about a loan for it. For a consumer loan, the rate will be from 14,9% in year.

For the convenience of comparing the best banks, the main conditions and interest rates on loans are presented in the table.

Table "TOP-3 banks with the best business lending conditions":

| Credit organization | Maximum loan amount | Rate | Other programs |

| Sberbank | 3 million rubles | From 16.5% per annum under the Trust program | Special offers for the purchase of vehicles and equipment developed |

| Raiffeisenbank | 4,5 million rubles | From 12.9% per annum | Get help choosing a program by phone |

| VTB Bank of Moscow | 3 million rubles and more | From 14.9% per annum | A wide range of programs for opening and operating activities |

From the table you can choose a bank for a business loan with favorable conditions and low interest rates.

7. Concessional loans to small businesses - where and how to get help from the state

Today, a considerable number of Russian citizens plan to open their own business. To do this, required idea and money. With the first, everything is more or less clear. Everyone usually has an idea or is adopted by other companies.

However, not everyone has the means to organize a business. Given the rather high rate offered by banks to novice businessmen, we can say that it is almost impossible to get them for beginners.

The state comes to the rescue. As part of supporting small businesses, it offers a range of loan programs. However, before you agree to any of them, you should carefully study all possible ways to get help from the state.

7.1. Types of Government Loans for Small Businesses

The state today is trying to support small businesses. First of all, it is expressed in special credit programs, of which several have been developed. They differ primarily in the form of assistance, as well as in the entity entitled to such support.

1) Microcredit for small companies

Russian regions have fundsintended for microcrediting small and medium enterprises.

It is these companies that are engaged in obtaining loans with state assistance to businessmen. The conditions for issuing loans vary depending on the region in which they are issued.

The main plus (+) concessional lending favors high availability. Money can be obtained regardless of the area in which the company or entrepreneur works.

It is worth keeping in mind that in different regions lending through funds may overlap limitations.

In general, the conditions of state loans for small businesses are characterized by the following:

- The organization or entrepreneur must be registered in the region in which the loan is planned;

- Amount in most cases does not exceed 1,5 million rubles, but for some industries or constituent entities of the Russian Federation, the loan amount may be reduced;

- The rate for state lending is determined by a large number of factors - business prospects, market needs, solvency of a potential borrower, availability of collateral, value of collateral, loan size and term. On average, it varies within from 8 to 12%;

- The issuance of credit funds is made by bank transfer;

- Is acting limitation the number of possible loans;

- In most cases, you will have to provide a loan security. It could be a guarantee eg, property or current assets, as well as a guarantee;

- If the conditions stipulated by the state loan agreement are not observed, the borrower is subject to fine. The most common sanctions are increased interest rates;

- After providing a full package of documents, the application will have to wait for a period from 5 before 10 days. The length of the term is determined by the subject in which the registration takes place.

2) State guarantee

In this case, lending is carried out through a commercial bank. The state fund is becoming guarantor under a loan agreement represented by the Federal Notary Chamber.

Borrowers need to understand that far from all credit organizations participate in state lending. To find out which bank to contact, you should visit the official website of the Russian government.

In fact, the conditions of a loan under state guarantee do not differ much from those offered under traditional lending.

It should be prepared for the fact that the consideration of the application can last quite a long time. Moreover, it is not uncommon for a fund to become a surety only in terms of a loan amount.

It is important to know that traditionally preference in the guarantee is given to the following borrowers:

- manufacturing and industrial companies;

- organizations serving citizens in the social sphere;

- innovative companies.

When considering applications for state guarantees, the fund takes into account how many jobs were created by the potential borrower.

3) Subsidies

For most businessmen subsidies are the most attractive type of government assistance. This is due to the fact that subsidies are provided absolutely free. But do not flatter yourself - only some businessmen can receive such help.

In order to count on the allocation of subsidies, you will have to comply with a number of strict restrictions:

- apply to the Employment Center and go through the procedure of registration as unemployed;

- pass a psychological test at the Employment Center;

- sign up and take a course in Entrepreneurship;

- write and submit a business plan.

When the application for a subsidy is considered, the businessman must register as an individual entrepreneur or organization. Only after that will the borrowed funds be transferred to him.

Worth considering! After getting a loan all costs will have to be documented. It is necessary that they exactly correspond to the business plan submitted for consideration to the bank.

Most often, the subsidy is provided for the following needs:

- acquisition or leasing of real estate for carrying out activities;

- purchase of goods for trade;

- acquisition of equipment, as well as intangible assets.

The need for them must be indicated in the business plan. But do not rejoice ahead of time - most applications for subsidies are refused.

4) Grant

Grant acts as another type of assistance to entrepreneurs, which is free of charge. Naturally, not everyone can get such funds. This is what many consider the main disadvantage of grants.

The following categories of businessmen are eligible to receive the type of state assistance in question:

- Entrepreneurs who have recently started operations and have been working for less than a year;

- organizations that have created a large number of jobs;

- a prerequisite for grant approval for applicants is the absence of debts on loans and payments to the budget.

When considering a grant application, the scope of the businessman’s activities is also taken into account. It should be borne in mind that each subject of the Russian Federation independently determines which areas grants are given to.

5) Compensation payments, as well as tax relief

Compensation Payments represent the return by the state of part of the funds spent on the development of activities.

Businessmen working in the following areas can receive payment from the state:

- innovative production;

- production of import-substituting products;

- service industry enterprises.

Tax relief are the so-called tax holidays. They mean exemption of a business from tax payments for several periods - usually no more than 2 years.

Businessmen can rely on tax holidays if the following conditions are met:

- activity started recently;

- when choosing a tax system, the entrepreneur preferred a simplified or patent system;

- the company works in the manufacturing, social welfare or science fields.

7.2. Requirements for borrowers and loan features

The requirements for potential borrowers, as well as the main features of the provision of loans are determined primarily by what program the businessman is applying for. To facilitate the consideration and comparison of these parameters allows their reflection in the table below.

Table of differences in lending conditions and requirements for the borrower depending on the type of state support for business:

| Credit requirements | Program features |

| Microcredit for small companies | |

| Registration of business in the territory of the subject of the Russian Federation, in which it is planned to issue a loan Pledging liquid expensive property | The purpose of the provision is the development and support of small as well as medium-sized enterprises Loan term does not exceed 12 months |

| State guarantee | |

| You should contact the credit organization participating in the state program Business must be registered at least six months ago Activities should be carried out in the region of the loan Lack of debt on loans and payments to the budget Part of the interest will have to be repaid by own funds | It is easiest to get funds for companies working in the field of production, innovative technologies, construction, public services, transportation, medicine, housing and communal services, tourism within Russia It will not be possible to issue businessmen involved in gambling, insurance, banking, pawnshops and securities funds |

| Subsidies | |

| Each Russian region itself determines which areas of activity are most significant for it. The subsidy is for them. Be sure to provide a business plan Subsidies are intended only for individual entrepreneurs and LLC A businessman will have to pay a certain amount of the funds owned by him | Subsidies are given for the purchase of raw materials, materials, equipment for production, as well as intangible resources The term of the loan agreement is minimal - does not exceed 12-24 months |

| Grant | |

| No more business 12 months Credit history must be crystal clear The company created a significant number of jobs for the region No government benefits have been received previously. There are enough savings to make a down payment | Money is provided only to entrepreneurs and companies related to small and medium-sized businesses |

| Compensation Payments | |

| Designed for companies working in the field of innovation and the provision of services producing import substitution goods | Designed for the development of small and medium-sized businesses |

| Tax relief | |

| Doing business no more 12 months A simplified or patent tax system is used Designed for production associations, companies from the scientific sphere, services for the population | Tax breaks are available for a maximum of 24 of the month |

Thus, the following categories of businessmen have the opportunity to receive state assistance:

- starting a business from scratch less 1 years ago;

- the company operates in the manufacturing or innovation sector or provides services to the public;

- There are no problems with loans and payments to the budget.

7.3. Where to go for state assistance

For a specific category of assistance, businessmen should contact the government agency that is responsible for it. Below are the main ones.

If a businessman wishes to participate in a microfinance programhe should head Entrepreneurship Support Fundlocated in the subject of the Russian Federation, where the activity is registered and conducted.

In this case, you will have to provide a certain list of documents. It differs for various legal forms, as well as regions. The full list can be found by visiting the Foundation website of a specific subject of the Russian Federation.

However, you can name a number of documents that are required without fail:

- an application for state assistance can be downloaded on the official website of the Fund;

- application form, as well as copies of passports and SNILS certificates, both of the borrower and the guarantor;

- constituent documents;

- certificate of tax registration;

- reporting documents;

- certificate of state registration;

- extract from the Unified State Register of Legal Entities or the USRIP;

- extract from the register of small and medium-sized businesses;

- if available, license and patent.

To receive assistance in the form of state guarantee, should contact to the bankwho takes part in the corresponding program.

The package of documents will practically not differ from the one described above. Additionally, you will need to fill out application on state guarantee.

After that, the credit institution will directly consider the package of documents and transfer it to Fund. There they will be studied again during 3days.

To receive a grant, grant or compensation payment should be contacted to the labor exchange (Employment Center). The main documents will be requestas well as competently composed business plan.

If a businessman’s goal is to get a tax break, should be sent to the Federal Tax Service Inspectorate. It is there that you can get all the information, as well as a list of necessary documents.

Practical advice on how to get a loan under a business plan for opening and developing your business

Practical advice on how to get a loan under a business plan for opening and developing your business

8. How to get a loan under a business plan for starting a business - 6 useful tips from experts

Money is constantly required for a business: at the stage of opening, as well as the development of activities, it is impossible to do without an infusion of additional funds.

In most cases, a loan is the best solution for 2 main reasons:

- Withdraw funds from circulation is far from always effective. Such actions can lead to lower profits, as well as production volumes;

- When you start your own business, time often plays against a businessman. Therefore, in such a situation, it is also worth thinking about a loan, and not save up a sufficient amount.

The borrower will have to convince the bank of its solvency. Most often, for this purpose it is required to provide business plan. To facilitate the task of obtaining a loan for the purposes described in this important document, you should clearly understand the rules for its preparation.

Tips for preparing a business plan for a loan:

Tip 1. It’s best to write a business plan yourself. Not always for this it is worth resorting to the services of third-party organizations and individuals.

Many banks offer businessmen a form for a business plan. Writing it in such a pattern is quite affordable for an entrepreneur, accountant or economist who are closely acquainted with the company and can better justify the need for credit.

If for some reason you still decide to seek the help of a third-party specialist, you should ask him in advance if he has written business plans for credit organizations before.

Tip 2. All necessary agreements (for example, lease agreements, deliveries of goods and equipment, etc.) are best concluded in advance.

If you manage to collect the maximum of preliminary agreements required to achieve the goal of obtaining a loan, you can count on a more loyal attitude of the bank.

Tip 3. It is desirable that the purpose of lending is not provided in full by borrowed funds, part should be paid by the businessman’s own funds.

If your money will be no less 20%, you can significantly increase the confidence of the bank. It is only natural that creditors are loyal to those businessmen who are not afraid to risk their own funds.

Tip 4. If a business needs to receive a large sum of money for a long period, it is worth contacting a bank whose client the company is already.

Most often it is a credit institution with a constantly used current account.

If a businessman has already received several times at this bank and has successfully repaid the loans, they are practically not refused a new loan (even a large amount).

Tip 5. The most important thing that should be reflected in the business plan is financial calculations. This is especially true of potential profits from investing borrowed funds in the project.

In addition, do not bypass the issues of repayment of the loan. Ideally, even before obtaining a loan, it is desirable to have sufficient income to make monthly payments.

Important! Marketing component of a business plan usually studied by bank employees not too carefully. But it is worthwhile to ensure that there are no contradictions between this section and other components of the document.

Tip 6. Before visiting a bank, an employee who will represent the interests of the company to creditors should carefully read the business plan from start to finish.

In this case, he will be able, quickly and efficiently answering questions, to prove to the bank a real possibility of development with the help of credit money.

It is important to approach the preparation of a business plan as responsibly as possible. This will help to significantly increase the chances of a positive decision on the loan application.

9. Frequently asked questions (FAQ) for lending to small and medium-sized businesses

Business lending - The question is vast and multifaceted. That is why when studying this topic, a huge number of questions arise. There will be no answer to everything within this section. Nevertheless, we give further answers to the most popular questions.

Question 1. Are there any problems in lending to small businesses in Russia today?

Today, the Russian government is making a tremendous amount of effort to support small businesses.

Important to understand that no business project can be launched without the necessary amount of funds. It is start-up capital that is the most important factor in creating a company.

However, not all businessmen have sufficient funds to open their own business. Able to cope with a problem business lending. It is this way of getting capital that is the most popular when creating a new business.

At the same time, Russian banks do not always have a desire to issue loans to new companies. Positive decision is accepted no more than 10% applications.

This is explained quite simply - lending to a newly created business is always fraught with great risk, which banks do not seek to assume.

Quite often, new projects do not live up to the expectations of their owners. As a result, the business does not become profitable. In this case, there will be nothing to pay for the loan received. It turns out that lending to small businesses is unprofitable for lenders.

Banks with a much greater desire to issue loans to large organizations for the following reasons:

- with such companies you can get more income, because they prefer to borrow large amounts immediately;

- most of them have been operating in the market for a long time and usually already have a certain reputation. As a result, the probability of timely payment of monthly payments increases significantly.

However contrary to the opinion that large companies are serious borrowers, it is far from always that they regularly fulfill their obligations.

As a result, banks are more loyal to small companies that are highly rated by rating and audit firms.

These organizations give the most objective assessment of the activities of any businessman. In their report, they take into account not only current performance indicators, but also forecasted ones.

Term of activity The potential borrower also plays a significant role in the process of making decisions by the bank on submitted applications. It is not necessary that the age of the company be measured in tens of years. However the higher it is, the more likely it is to approve the application.

In Russia, obtaining a loan to create an activity is much more difficult than to develop it. In this case, serious work will have to be done to analyze potential financial indicators and draw up a business plan.

Question 2. What are the conditions for issuing loans to small businesses secured by real estate?

Real estate is the most attractive guarantee for many banks. The only requirement is high liquidity and availability of demand to a specific object. That is why when obtaining a loan for a business secured by real estate, you can count on the most favorable conditions.

The pluses (+) of business loans secured by real estate include:

- extended loan term, which can reach 10 years;

- lower rate than for unsecured programs;

- there is no need to provide a business plan, or the attitude to this document is as loyal as possible;

- high speed of registration;

- often a loan agreement provides deferred payment.

Despite a significant number of advantages, loans secured by real estate to businessmen have several disadvantages.

The minuses (-) of such loans include:

- possible loan amount usually does not exceed 60% from the estimated value. Therefore, to borrow a large amount is unlikely to succeed;

- valuation of collateral in most cases, it is carried out by employees of a credit institution or a company that cooperates with the bank. The result may be an understated amount in the report of the appraiser. Naturally, as a result, the loan amount is often lower than the borrower expected.

It should also be borne in mind that the provision of real estate as a pledge does not guarantee a positive decision of the bank on the submitted application.

Read more about loans secured by real estate in a separate article in our magazine.

Question 3. What if I urgently need a cash loan to create a small business from scratch?

Not always businessmen manage to get a loan to start a business from scratch, especially in cash. However, even if the banks refused, there is a chance to get money in debt.

Experts advise you to use one of the options described below.

Alternative business loan options

Alternative business loan options

Option 1. Registration of a consumer loan as an individual

Businessmen can take a consumer loan if they have income as an individual. However, in most cases, the size of a consumer loan is not enough to organize a business.

Option 2. Credit Card

If a small amount is not enough for organizing a business, which is planned to be returned as soon as possible, you can arrange credit card.

Advantage This product is the possibility of obtaining a loan without interest.

Today, the most popular credit cards are offers from the following banks:

- Alfa Bank - the maximum limit is 500 000 rubles. The grace period is 100 days. It applies, including cash withdrawals;

- Tinkoff offers a credit card in the amount of before 300 000 rubles. The card is issued free of charge and delivered to your home or office. The interest-free period is 55 days;

- Bank Renaissance Offers a credit card with free issue and service. The maximum loan amount for it is 200 000 rubles. The grace period is 55 days.

It is important to carefully study in advance the conditions for providing a credit card, the possibility of payment and cash withdrawal, tariffs and commissions.

Option 3. Partnership with a large major company

Having entered into a partnership with a major major company, you can get money to organize your own business. But far from always experienced businessmen want to finance start-up entrepreneurs.

To achieve this, you have to prove the attractiveness of the project. High quality is able to help with this. business plan.

Option 4. Collaboration with the Entrepreneurship Support Center

In Russia, there is support for certain areas of small business activity. Entrepreneurs who are confident that their company will create the service or product needed by the country should contact the following organizations for help:

- Business Incubators;

- Small Business Support Centers;

- other government bodies providing assistance to entrepreneurs.

The named organizations can be found in any fairly large city. They provide assistance to businessmen in the form of a guarantee for them on a loan, as well as payment of part of the debt.

Companies working in the following areas of activity can expect to receive state support:

- construction;

- Agriculture;

- services for the population;

- production as well as distribution of resources;

- transportation;

- communication.

We also recommend that you read our article on how to take an express cash loan on the day of applying for a passport.

Question 4. How to get a loan to buy a ready-made business?

Not everyone succeeds in running their own business, sometimes entrepreneurs ask themselves, what to do if the company is already established. At the same time, it’s easier to buy an activity than to organize it yourself.

All this leads to the appearance on the market of such an unusual product as ready business, and many banks have developed special loan programs to purchase it.

However, in the process of obtaining such a loan, some problems may arise. To reduce the likelihood of a collision with them, it is important to carefully study the features of lending to acquire a ready-made business.

One of the features of such lending is that managers of small companies often use various tricks to understate their profit. They do this to reduce the cost of tax and budget payments. The result of such actions is that in the official reporting of the company little profit is reflected or it even looks unprofitable.

If another businessman wants to acquire a similar company at the expense of credit funds, the bank is likely to refuse him. No lender wants to give out funds to acquire a loss-making business. That is why, if you want to buy a ready-made business, it is important to provide the bank with real information about expenses, incomes and profits.

Do not think that banks when considering applications rely only on official datae. Credit organizations are well aware of how businessmen conduct their activities.

Therefore, they are quite loyal to them and can use for consideration factual data. But do not expect that the bank will take the applicant’s word. In any case, it will be necessary to confirm each figure with internal documents.

To acquire a ready-made business with the involvement of credit funds, you will have to perform a number of actions:

- The future borrower chooses an existing business for the acquisition and conducts a qualitative analysis of its profitability. Ideally, it’s worth composing business plan. This document will help not only to carefully study all the features of the acquired company, but also to evaluate the profitability of potential investments. In the future, a business plan will come in handy to justify the advisability of obtaining a loan.

- If the results of a business study satisfy an entrepreneur, he should go to the choice of bank, loan program and analysis of loan conditions. As soon as a decision on the location of the loan is made, you can file application. To do this, you need to provide the necessary package of documents.

- Having received the documents, the bank employees carry out their assessment. The analysis is carried out in 2directions: solvency of a potential borrower, profitability of future investments. Often a visit is made to the place of business of the acquired activity. The final decision on granting a loan is made by the credit committee.

- A loan agreement is being drawn up. Its conditions in most cases are developed individually.

- After this, the agreement is signed by the two parties.. However, the future borrower must carefully study the contract. BEFORE of how to put his signature under it.

- Payment of down payment. Its size is determined by the loan agreement. In most cases, an amount of from 10 to 40% the value of the acquired business.

- The bank transfers funds to the borrower's account.

If you decide to acquire a franchise business, the procedure is carried out in several stages:

- The future borrower attends classes on business development conducted by a credit institution;

- Bank employees carry out a preliminary analysis of a potential borrower;

- The franchisor is considering the possibility of concluding an agreement with a businessman;

- If the franchisor makes a positive decision, the bank considers the loan application. If approval is obtained from the creditor, a loan is issued and funds are transferred to the franchisor.

When purchasing a franchise using credit funds, the bank and the seller of the brand do everything for the businessman to learn how to conduct business. They teach him the basics of company management.

Question 5. What are the pros and cons of a franchise business loan?

Getting a franchise business loan

Getting a franchise business loan

Interested in obtaining loans to create a business using a franchise 3 side:

- Franchisor strives to get the maximum income from providing businessmen with the opportunity to conduct activities under their own brand;

- Businessman interested in obtaining a loan to create your own business. Do not forget that in most cases it is more profitable for an entrepreneur to obtain a loan for a franchise;

- Banks want to draw up the maximum number of loans for a franchise, which will be profitable. In other words, they seek to receive maximum income as a percentage of loans issued. Creating a franchise-based business is always more attractive for lending than starting from scratch.

Among the advantages of loans for starting a business using a franchise, the following can be distinguished:

- the ability to quickly acquire the equipment necessary for conducting business;

- high speed of market coverage;

- almost instant purchase of materials and other goods, without which business is impossible;

- there is no need to independently organize your own advertising company, the franchise owner does this;

- business from the very beginning is conducted under a popular brand using a well-known brand;

- The project provides training for the entrepreneur in business management and working strategies.

Despite the huge number of advantages, obtaining loans for a franchise has its drawbacks.

The disadvantages of franchise loans include:

- The term for repayment of loans under consideration is usually quite limited. This entails additional risks, because it is not always possible to repay a debt in such a short period;

- In most cases, collateral is required in the form of a pledge or guarantee. This is far from always convenient for a businessman;

- Banks are picky about the business plan presented. Far from always they agree with the presentation of the project that the entrepreneur has. Moreover, the bank may consider that the existing business plan does not constitute a high-quality preparation for the start of operations;

- A loan always entails additional costs. This is not only interest, but also insurance contributions, registration fees and other payments;

If there is a desire to issue international franchise, it should be understood that accounting costs will increase significantly. Accountancy and audit will have to be carried out in accordance with international standards. In addition, you will have to spend money on translations and adaptation of activities.

It must be understood that the bank will make every effort to gain confidence in the repayment of the debt with interest. That is why it is necessary to take into account the following criteria:

- mandatory state registration as an individual entrepreneur or legal entity;

- the presence of the highest possible credit history, the minimum number of problems with repayment of loans in the past;

- the probability of a positive decision will be higher if a preliminary agreement with the brand owner is signed in advance;

- the credit reputation of the guarantors is of great importance, his work in the field of the franchisor will be an additional plus;

- the presence of a businessman’s expensive property and consent to transfer them as collateral also increases the chance of obtaining a loan.

The above circumstances can convince both the lender and the brand owner of the reliability and prospects of the businessman.

But it’s worth keeping in mind that you can get funds to create activities based on a franchise not only with bank lending.

You can also open your own business using a franchise using the following options:

- the franchisor himself provides a loan to anyone wishing to organize activities using his brand;

- a non-purpose loan is issued at the bank, in this case it is better not to mention that the money is borrowed to create a business;

- a loan from relatives, friends or acquaintances.

Question 6. How to get a business loan to the unemployed?

Not everyone agrees and can work for hire. Such citizens usually seek to organize own business.

However, this requires a sufficiently large sum of money. In most cases, the unemployed do not have such savings. That is why the question arises, Is it possible for such categories of citizens to borrow the necessary amount somewhere?

In fact, you can get money for starting a business for the unemployed. For this, it is worth contacting special organizations that assist in the provision of state assistance to novice entrepreneurs.

First of all, you must fulfill the important conditions for the provision of a loan:

- future businessman must be registered in Employment center;

- it is necessary to register activity as individual entrepreneur or legal entity;

- develop quality business plan.

When these conditions are met, the possibility of providing a loan will be considered The Foundationsupporting the development of entrepreneurship. Only after passing through this structure will they begin to consider cans.

Many believe that getting loan for a new business from scratch to the unemployed is a complicated and hopeless business.

But it’s worth keeping in mind that the borrower can be lucky and he will be able to get a free amount to start his own business (startup) from the state. Therefore, trying to use this option is worth it.

There are ways to increase the likelihood of issuing a loan to the unemployed:

- provision of security in the form of collateral or guarantors;

- apply to lenders who lend to start-up businessmen;

- attempt to get a consumer loan.

It is important to remember that when submitting an application, you should be as honest as possible. Trying to trick a potential lender, you can get into the lists of malicious violators who will be very difficult to get money in debt in the future.

In addition, you should prepare a quality business plan in advance. If the idea is detailed in paper rather than in words, the likelihood of approval of the application will increase significantly.

Question 7. How to file an online application for a loan for a small business?

Exist 2 The main ways to apply for a loan to create and develop a business online:

- on the official website of the selected bank;

- using a brokerage site.

The sequence of actions when submitting an application through the bank's website is as follows:

- go to the official website of the credit organization;

- study the terms of the loan program;

- fill out a questionnaire, which includes the basic data of the borrower;

- send an application and wait for consideration.

Important! When using a brokerage site, the user gets the opportunity, by visiting one resource, to compare offers of a large number of banks.

To submit an application through a brokerage website, you will have to overcome a number of stages:

- Visit the site of the loan broker.Finding it is quite simple using any search engine;

- The site should go to the section on business lending;

- Comparing the conditions of the proposals, you need to click on the button to submit an application in the line of the selected bank;

- It remains to fill out a short form;

- When the necessary data are entered, you can send an application and wait for the decision of the bank.

It should be understood that when applying online, the decision of the bank will be preliminary. If approved, you will have to visit the bank office with the originals of the necessary documents.

10. Conclusion + video on the topic

Unfortunately, to create your own business, just a quality business idea is not enough. Also need cash investments, often quite large. Not everyone has the necessary amount, but there is a way out - you can get a loan.

There are a lot of loans and credits for opening or developing a business. Moreover, there is a chance to receive a certain amount free of charge as assistance from the state. It is important to make maximum efforts when exploring possible options and programs.

In conclusion, we recommend watching a video on the topic:

The team of the online magazine RichPro.ru wishes readers a successful and profitable business. Let all the lending programs used by you be the most profitable.

Leave your comments below, share the article on social networks with your friends. See you soon!