Currency market (exchange) Forex - what it is like to trade and make money on Forex from scratch + the best indicators and trading strategies of Forex for beginners

Welcome readers of the financial magazine Rich Pro! In this article, you will learn what Forex is and how to make money on it, how to trade profitably in the Forex market, what Forex strategies and indicators really work.

Detailed step-by-step instructions for making Forex trading will help a beginner and a novice trader to start trading in the foreign exchange market from scratch, and information on the most Popular Forex Indicators and Strategies - decide on your trading system.

So, let's begin!

Forex currency market: what is it and how it works, what indicators and forex trading strategies are better for a beginner to use, how to start trading and making money on Forex - read in this article

Forex currency market: what is it and how it works, what indicators and forex trading strategies are better for a beginner to use, how to start trading and making money on Forex - read in this article

1. What is Forex and how it works - a review of the concept + an example of earnings

Let's first understand what the Forex market is.

Forex trading (Forex, from the English. FOReign EXchange - "foreign exchange") - it is an international currency market. It represents a certain virtual space in which the value of financial instruments is formed in real time - currencies of various countries.

A huge number of large and small investors, companies and individuals are attracted here daily. As a result, Forex turnover on average every day is four trillion dollars.

Forex market liquidity is at a very high level. Anyone can purchase or sell an unlimited amount of foreign currency here. This allows you to get a good income.

A distinctive feature of Forex from the stock market is that it does not have a single trading platform. This is because the market has an international status and is conditionally divided into trading sessions: American, European and Asian.

Forex operates around the clock five days a week (excluding national holidays). This means that in this market you can earn at any convenient time.

In fact, there is no daily trading session on the Forex exchange, but a weekly session. She opens at 23:00 GMT (Sunday) on Sunday in Tokyo, and closes at 22:00 on Friday in Chicago.

This market was developed only so that large firms, banking organizations and even entire countries could exchange money from one currency to another in a convenient place. For instanceexchange euro to dollars, francs on yen and so on.

But in 1971, as soon as the market arose, they began to be attracted to it financial speculators. Then they began to call such people traders.

Trader from the English translation means "merchant". This word refers to people who perform speculative operations, which result in profits in the currency and stock markets.

Any person who begins to trade Forex will automatically become a trader. He gains a difficult and highly paid profession, which has a lot of risks.

A simple example: how to make money on Forex in real life

We give an example from everyday life, how they earn money on Forex.

Everyone knows that recently the coursedollar and Euro changes very much in relation toI chop.

Let's pretend that 1 dollar = 60 rubles. By investing60 000 rubles can buy 1000 dollars. In few days dollar starts to grow and stands already 65 rubles. Now selling 1000 dollarswe get an income of 5000 rubles.

This is just a rough example.In reality, exchange transactions are still withdrawn commission. But in principle, the general meaning is clear.

Currency speculation for profit can be compared with ordinary actions market traders. For example, a person in a big city buys cucumbers at the market 50 rubles per kg. Then he comes to his village and starts selling the same cucumbers to residents 70 rubles per kg. The difference between the purchase and sale price (minus the cost of the road, etc.) is left to itself.

Important!

But in the Forex market, profits are NOT constant. The price for the exchange may not rise, but to fall. In this case, a person should either sell $ 1,000 and calculate their losses, or wait for the price increase.

Also exists another option possible forex trading.

Suppose bought dollars behind rubles, and the price of them starts fall. In this case, you can buy cheaper dollars to average initial purchase price. After that, wait for the price increase and sell the available funds.

Such an exchange operation is an element of the trading strategy, which is called averaging. Not always "averaging" gives a positive result, because the price of the currency can continue to decline and then the person will bear big losses.

Is it possible to make money on Forex without having initial capital, and what conditions must be met for successful work on the currency exchange - more on this later

Is it possible to make money on Forex without having initial capital, and what conditions must be met for successful work on the currency exchange - more on this later

2. Is it realistic to make money on Forex and how to do it without investments

It is absolutely realistic to make large sums of money in the Forex market for short periods of time, and this prospect attracts many novice traders and investors from around the world.

But for profit on Forex availability of trading capital. That is, you can only make money if if money is invested in one of the currencies that can later be sold. (We talked about ways to invest money for profit in the article “Where to invest in order to earn money” - expert advice will help you make the right choice).

As a result, answering the question, is it possible to earn money without investing money on Forex, the answer is no. Here another question should be asked, whose money trade will be carried out.

Next, we consider several ways to make money in the Forex market without having your own trading capital.

2.1. How to make money on Forex without investing your money - 3 real ways

By the way, you can trade financial assets (currency, stocks, cryptocurrency) directly on the stock exchange. The main thing is to choose a reliable broker. One of the best is this brokerage company.

You can earn on Forex without investing your own funds. But for this, a person must have experience and accurate knowledge principles of trade. At the same time, he should have confidence in his actions.

So, how can you make money on Forex without investing your money.

Method 1 The job is to provide consultations the person who will trade on Forex. For this service, the consultant will receive a percentage of the transaction.

Consultant work It requires constant analysis of the current situation in the market, including in the world. For such intellectual work, people receive a very decent salary.

Method 2 You can not just give advice, but become hired trader for a person who wants to invest their money in Forex. Those are, this person will open his trading account on which the hired trader will trade himself. In this case, earnings are divided by agreement. for example, profits can be divided in half.

If such work really bears fruit, then there will be a lot of investors who want to profit in this way.

Method 3 Earnings on Forex affiliate programs. If you decide to start making money on affiliate programs of Forex brokers, you will be able to provide yourself with a good and stable income without any special risks and costs.

2.2. 4 prerequisites for successful work in the foreign exchange market

In order for currency trading to begin to bring significant profit, you must adhere to the following basic conditions, without which it will not be possible to become a successful trader.

Condition No. 1. Initial capital

Lovers of freebies get a lot of profit quickly and at the same time, without investing their own funds, they can not in the Forex market. Immediately quickly, simply and without investment, you can receive money, as a rule, in a criminal or morally unacceptable way. But there are legal options. Read about how to make money fast in one of our articles.

Note!

To get started, it’s worth learning that thinking is not about money, but about about percent. All Forex trading involves speculation and investment.

The best result of earnings is considered stable income, which equals 3-10% per month from the invested amount. The trader can receive these funds if he does not replenish his trading capital at the expense of them, but simply withdraws and spends on his needs.

If a trader wants to constantly increase his account for trading, then the profit will constantly increase. After all, at the same time one percent overlaps another, therefore, the amount of income varies. Thus, a trader in a year can make a profit from 100% to 500% per annum.

But such data is theoretical. In practice, only a couple of one hundred people get profit on the Forex market, which equals 7-13% per annum

Therefore, if you want to receive $ 100 daily, then you will need to invest capital, which will exceed this amount by 10 times.

Condition No. 2. Specific knowledge and experience

Without knowledge and experience, not a single person on Forex can make a profit. These data can be obtained from articles, specialized literature and videos. On our website there is an article “Forex Training for Beginners from scratch”, where you can learn the basics of trading in the Forex currency market.

You can also try to trade on virtual account. This will be a very good workout.

Best to learn from good mentor. This should be a person who has extensive trading experience, while constantly earning on Forex and has the ability to learn.

This person can share his knowledge absolutely is free or for a small symbolic fee. But this is only if a person does not need money and takes great pleasure in teaching others.

But in most cases, mentors ask for a decent fee for sharing their experience. In this case, such a person should be required warranty to get the result. True, luck to a greater extent primarily depends solely on the person himself, on his quality characteristics and the ability to make the right trading decisions.

Only a little work on Forex, you can determine for yourself whether this market is a fantasy or a real place to earn good income.

The search for a mentor should be carried out:

- In the circle of friends and acquaintances;

- On the Internet, going to thematic forums at Forex;

- At a special seminar or event organized for traders;

- In a brokerage firm or dealing center located in the city of residence.

What features should be considered when choosing a mentor:

- Forex market should be the main work of this person. After all, getting big earnings, an experienced trader will not look for other ways to increase income. If for a person this is just hobby, then you should think about it, but is it worth it to choose as a mentor.

- A person must provide their income results over the past year. Moreover, data should be presented from all accounts held by him.Since the market situation is constantly changing, the profit made in one month may become a loss in the same amount in another month. Therefore very important analyze the report of the future mentor for a long period of time.

Why is it required to find out the availability of all accounts? If a person works in the Forex market with several trading capitals, then in one place he may have a good result, but not in another. A mentor can only show an account with good forecasts, and can hide unsuccessful trades.

- It is worth personally seeing how a person conducts work. To do this, you can arrange a meeting and sit to see how the exchange of currencies occurs on real accounts. If the mentor has positive dynamics, then he will not hide his work. In doing so, he must discover real trading account and begin to make operations on Forex, explaining all your actions.

Condition No. 3. Good nerves and a lot of time

As soon as the money is invested in any currency, you can immediately observe the fluctuations in the price and available funds in the account.

Let's say, the following situation may occur on Forex. They opened the operation, and two minutes later starts to flash "+150$", but after 6-9 minutes already coming to screen "-180$".

In this case, of course, it was desirable to close the deal when a plus appeared (+) But not always after a couple of minutes, a minus (−) There is also the possibility that a plus will increase. It is this desire that arises among traders who begin to trade. But such greed does not always bring positive results.

Consider another case of trading. For example, when opening a transaction, a minus appeared on the screen, and fears of losing all their capital incite the trader to close this position. After all, no one knows if he will minus plus or minus will continue to increase.

To start earning a stable income on Forex, you need to clearly understand all the principles of work, and it will take a lot of time.

Typically, traders start earning income later few months or even later some years.

Condition No. 4. Cash reserve

Any speculative operation has risks. In the Forex market, this is associated with large losses of cash.

Such work can be compared with your own business. And in any business there is a golden rule risk management.

You should never open your own business for the latest savings. To a greater extent, this applies to people who do not have good experience in this field. There is an article on our website that details how to open a business from scratch and where to start a novice entrepreneur.

Take note!

Forex market statistics show that most novice traders lose all invested money in the first working week.

Therefore, it is recommended to start activities in Forex with cash, which in case of loss will not affect the family budget. This should happen until the trader has gained enough experience.

It is very good if there is an additional source of income that is not taken into account in the distribution of the family budget. It would not be a pity for such money to work and quick disappointment in currency speculation would not appear.

By the way, Forex trading is similar to binary options trading. About binary options - what is it and whether it is possible to make money from them, we wrote in one of our articles, where you will find complete and detailed information about trading options, varieties of strategies and indicators.

Basic and proven ways to make money in the Forex market

Basic and proven ways to make money in the Forex market

3. How to make money on Forex - TOP-8 proven methods

Many people ask the question: “How to make money on Forex?”. However, not everyone knows that there are a large number of ways to do this.

Speculation and investment are the most popular ways to make money in the Forex market. At the same time, there are quite a few other options for making profit from Forex. Below we dwell in more detail on each of them.

Method 1. Self-Trading

By this option is meant directly market trading, that is, fairly regular purchase and sale of various currencies. Access to the exchange, as well as all transactions is carried out through a broker. Many successful traders work through this brokerage company.

Many people think that trading is not difficult. It is enough to study the state of the market, read expert forecasts, open deals and wait for money to flow into your pocket. However, this is fundamentally wrong.

To make money on speculation in currencies, you should study hard and for a long timecomprehending the basics of the market on their own or with the help of specialists. Gradually mastering all the nuances, the beginner develops, becoming an even more experienced trader.

In more detail about training in trading and what methods of obtaining knowledge in this area exist, we wrote in a previous publication.

Gaining experience in trading should be developed own trading strategy, continuously test her. If necessary, changes are made to the trading plan.

It is important to understand that success cannot be achieved only with the help of quality and volumetric knowledge. A trader should be able to remain calm in any situation, soberly evaluate the market. Forex is constantly jumping in different directions. This is able to pat the nerves even for professionals.

Drawdowns constantly occur in the accounts, which represent temporary losses. Experienced and calm professional traders will find a way out of this situation. Newcomers in 9 cases out of 10 bring the situation until the deposit is completely lost. Sometimes, to prevent this from happening, they continuously pour funds into the account. This continues until the possibilities are exhausted.

Despite the fact that independent trading has limitations, we can distinguish more significant advantages. You can drive it directly from home, equipping the workplace in accordance with your own preferences. It will take only a computer and high-quality Internet access.

Method 2. PAMM-account management

For successful traders who have already acquired knowledge and experience of exchange trading, Forex offers to develop further. If such speculators can guarantee some success in their operations, they may become managers.

To do this, open PAMM Account, attract investors and trade not only on your capital, but also on attracted money. This approach allows you to increase profits, as well as personal income due to commissions from investors. We already talked about PAMM accounts in more detail in one of our articles.

However, this is not an easy task. Not everyone is able to become a manager. Most people are in no hurry to entrust their money to unfamiliar traders even for the promise of a high income. Therefore, in order to attract investors, you will need to create a quality reputation for yourself. This can only be done if you have a successful trade. Initially, you will have to do this on your own capital.

Method 3. Trading based on professional operations (copying transactions)

Recently, trading, based on which lies copying operations performed by professionals. The popularity of this method is explained quite simply - a beginner will not have to study the basics of trade, conduct an independent analysis of the market situation, or make his own forecasts.

A huge number of services are presented on the Internet, with which you can automatically trade based on professional transactions. For those who decide to use them, it is important to choose the leading trader correctly. It often happens not easy for several reasons:

- Forex trading is fraught with significant risks, therefore, unprofitable transactions are also for professionals;

- many successful traders do not want to reveal the secret of their trading and share the developed strategy.

For these reasons, successful traders who are confident in their trading plan provide information about their transactions. for a fee. They receive either a specific commission or a percentage of the profits. But do not forget that in this case there is no absolute guarantee of the profitability of trade.

Method 4. Trading signals

This method is similar to the previous one. In this case, to carry out trading trading signals are bought through special platforms. Most common among them Metatrader.

As a result, the novice trader gets the opportunity to follow the professionals he chooses. Next, the program itself connects to them and automatically copies operations to the beginner’s account. It is important to establish the level of risk in advance.

If the transaction turns out to be profitable, the trader transfers the commission to the signal provider, which depends on the volume of the transaction. As a result, for both parties such transactions are quite profitable.

The convenience and simplicity of trading using signals is determined, including by the fact that they come in sms or in letters to the email account. As a result, the trader is notified on time about how best to act in the current market situation.

Method 5. Forex Advisers

Trading using trading robots or advisors has become the trend 21 centuries.

Forex Advisers are specially designed programs that are able to trade automatically; they do not require the participation of a trader.

It turns out that it is enough to install the program in the trading terminal, and it will open and close operations itself, making money.

Trading advisors use historical data on changes in the price of currencies, various indicators and other analysis tools. Regardless of the trader, such robots monitor the situation in the market. Based on available indicators, as well as other factors, robots automatically open and close deals.

The popularity of the method is explained by the almost complete automation of the trading process, the trader is not required to independently make calculations and market analysis. If desired, the robot can be configured in accordance with your own preferences in trading.

Method 6. Financial Betting

With this option, in order to get income, you must bet on in which direction the price will move. The main difference between this option and traditional trading is the lack of the need to purchase and sell foreign currencies. It is enough to bet on their growth⇑ or fall⇓ according to the same principle as in bookmakers. Read about how to place bets at bookmakers in a separate article in our magazine.

It turns out that betting on Forex is similar to casino. In this case, the income is determined by the size of the initial rate. The risk, of course, exists with this method of earning. However, with betting it is lower than with traditional trading.

Often, beginners are recommended to start working on Forex with this method. The direction of market movement is much easier to predict than to develop a full-fledged trading strategy. To do this, it’s enough to keep track of the news happening in the world and in the currency and finance markets.

In betting, various programs can help a trader. In them, it is enough to set the upper and lower limit of the rate in order to automatically assess the size of the risk. This helps the trader make the right choice. However, it’s impossible to automate anything more when earning money on financial betting. Then you have to rely only on yourself and your own intuition.

Method 7. Investments in PAMM accounts

Earnings by way of earning great popularity in the Forex market investing in PAMM accounts. Such an account is a collective investment, which is transferred to the trader in trust. The manager trades, operating with total capital, consisting of his own funds and funds of investors.

Benefits this way of earning is the lack of the need for independent trading. In order to minimize risks, you can create a portfolio that includes several successful PAMM accounts.

If you correctly distribute the assets, you can be sure that even in case of losses on one PAMM account, the investor will still remain in profit. Losses are covered by income generated on other accounts.

The investor must be prepared for the fact that the manager will have to pay for the services. Most often, commission is calculated as a percentage of profit. It may exceed 50% But do not be upset, because a high-quality portfolio of PAMM accounts can bring about 55% per annum (this is the average level).

Method 8. Partnership

This way of making money is interesting in that it requires absolutely no investment. At the same time, partnership, with due diligence, can bring good income.

affiliate program represents mutually beneficial cooperation of brokerage companies and users. The essence of such earnings is to attract new clients to the brokerage company. For each of them, the partner receives a certain payment. By the way, we already wrote about earning money on affiliate programs from scratch in one of our publications.

But don’t be scared partnership has nothing to do with network marketing, financial pyramids and other not quite legal schemes. This is actually a regular advertisement in which the partner is a kind of advertising agency.

Here you do not have to recruit anyone, forcibly force them to open an account with a broker. As in the case of regular advertising, it will be necessary to convey information to the consumer, and he will make a conclusion himself.

Forex exists 4 main type of partnership. Below will be considered each of them.

1) Web partnership

This option is the most common, it does not require huge knowledge about the work of financial markets. It’s enough for a partner to be an active Internet user and have a personal virtual space. Previously, it was only websitetoday are suitable for work as a partner blogs, forums, groups in social networks.

On such resources you will need to post various advertising information: banners, videos, announcements, etc. that will attract the attention of the user to the Forex broker.

Naturally, the success of such a partnership is largely determined by the level of popularity of the resource used.

2) IB office

This option is suitable for those who already have a fairly successful experience in Forex trading. Such a trader can share personal experience with other people. It can be friends and acquaintances or ordinary Internet users.

Talking about the opportunities that Forex trading offers, a trader tries to interest new clients and push him to open an account with his broker.

From operations concluded on the exchange by new users, the partner will receive a certain percentage in accordance with the agreement concluded with the brokerage company.

3) White label

This program is primarily intended for brokerage companies, investment firms, as well as of banks. Such organizations have their own customer base.

The presented affiliate program is suitable for those companies that want to get the following result:

- develop activities on the Forex using its own brand;

- expand the range of services offered;

- strengthen a favorable image;

- increase income.

In this case, there is no need to invest money, as well as spend personal time, distract from the main activity.The income with this type of partnership depends on the trade turnover on the accounts of the company's customers. It is transferred to a separate account opened as part of a partnership agreement.

4) Agent system

In this case, the broker is agency contract or representation agreement. There is no need to invest own funds, as well as to be distracted from the main activity. This type of earnings may well bring stable additional income.

Agent system represents a structure in trading using PAMM accounts, which is between the manager account and potential investors.

The agent’s task is to advertise the manager’s PAMM account, which should ultimately lead to capital growth in the PAMM account by making contributions by potential investors.

If during the fulfillment of the conditions of the agency agreement, the capital on the PAMM-account grows, the managing trader pays the agent a fee. Such income can be of two types:

- fee for attracted customers;

- percentage of profit, depending on the income received by the attracted investor.

There is nothing complicated in making money on affiliate programs. To do this, it is enough to register in an affiliate program of a broker. At the end of the procedure, the partner is issued special link, the transition through which new users will indicate their involvement by a specific partner.

It remains to correctly advertise the company, provoking the transition to this link. As soon as the terms of the partnership agreement are met, the partner will begin to receive the income due to him.

Thus, you can earn on Forex in a large number of ways. Everyone will be able to choose from them the one that suits him. In the selection process, you should focus on the level of knowledge of the Forex market, as well as the available capital.

I would like to note that the most effective option that provides the maximum income is combination of several ways of earning. for example, a trader or investor may well combine their activities with an affiliate program by advertising the services of a company with which they themselves collaborate.

Forex speculative trading - what are the advantages and disadvantages

Forex speculative trading - what are the advantages and disadvantages

4. Forex trading - the pros and cons of trading in the foreign exchange market

Let's try to consider the advantages and disadvantages of Forex trading.

4.1. Pros (+) of Forex Trading

The following advantages can be distinguished:

1) You can get income quickly and in large quantities. Of 100$ you can get in a day 1000$. But you should never forget about the possible risk.

2) Unlimited income. George Soros is a legendary trader who earned in just one night over a billion dollars. Therefore, in the Forex market there are no restrictions on earning funds.

3) The work itself is quite simple. Activities on Forex can be compared to using a mobile phone or playing games on a computer. The main thing to remember is that the results obtained are no longer toy-like.

4.2. Cons (-) of Forex Trading

Among the disadvantages are the following:

1) High probability of losing money. On Forex, you can lose all trading capital for several unsuccessful transactions.

2) Nervous work. Conduct exchanges for real money will make anyone worried. A person’s palms can sweat, a fast heartbeat can begin, and even as a result of such activity gray hair appears.

You should not engage in Forex trading for those people who have highly increased emotionality, there are problems with nerves or with cardiovascular diseases. When working on the stock exchange, you need to be calm and in an emotionally stable balance.

Sometimes people working in this field becomehighly dependent. For them Forex is already compared with casino. In this case, a person loses not only all the money, but also begins to sell valuables and borrow money.

Important!

People suffering gambling addiction, you can not start your business in the financial market. After all, gambling is considered a psychological disease that causes dependence on the process of activity.

Such a disease is quite common in people who like to play gambling for real money.

3) Unstable income. Even experienced traders have huge losses. Therefore, in a certain month you can get a very large income, and for another period you can stay with your trading capital or lose it to zero.

In this case, professional financiers recommend an analysis of their work for each quarter or for a whole year.

The newcomer in this case should realize that good income at the initial level does not guarantee the same stability in the future.

Forex Trading for Beginners - 10 Simple Steps on How and Where to Start Trading Forex + Criteria for Choosing a Forex Broker

Forex Trading for Beginners - 10 Simple Steps on How and Where to Start Trading Forex + Criteria for Choosing a Forex Broker

5. How to trade Forex - step-by-step instructions for beginners

This section will help beginners seamlessly transition from theory to practice. Here, step by step, all the actions that a novice trader will need to successfully trade are described.

Having carefully studied all the steps, you can already earn a small amount of money, and in the future, with more experience, become a professional trader.

Step number 1. We gain theoretical knowledge about stock trading

Do not immediately go to practice if there is no theoretical basis. Such actions will not bring the expected result. To obtain a theory, one should begin to study specialized literature, which speaks of the exchange, Forex, fundamental and technical analysis.

At first, it is recommended to study classic books on a relevant topic that will help a novice trader.

These include:

- George Soros - Alchemy of Finance;

- Thomas Oberlechner - "Psychology of the Forex market";

- Nassim Taleb - "Black Swan. Under the sign of unpredictability ”;

- Mark Douglas - Disciplined Trader and etc.

Even in YouTube, you can see information about the activities on Forex and listen to foreign exchange market analysts.

Step number 2. We determine the Forex broker

The more reliable the broker is, the more successful the trading will be.

Broker is the company through which all human transactions on the Forex market go.

In the foreign exchange market, it is not possible to independently register as an individual and make exchange processes. All actions take place exclusively through the forex broker.

📣 One of the best brokerage companies on the currency exchange is ForexClub.

How to choose a forex broker - 5 criteria for choosing a reliable broker

To choose the right brokerage company, you need to consider some points:

Criterion 1. Organization seriousness and work experience

You should not opt for brokerage companies whose activities in this area do not exceed three years. Also, such an organization must be officially registered. At the same time, she must have certain documents that give permission to conduct brokerage activities.

Criterion 2. Broker rating

There are sites on the Internet that have a list of the most popular brokers. It’s best to choose organizations that are not lower 10 lines. We also recommend that you read our rating of Forex brokers at the link.

Criterion 3. Minimum size of opening a trading account

Each brokerage company has its own minimum deposit amount. It can be either a few cents or several hundred dollars. Usually, all banking organizations have a very large minimum - from several thousand US dollars.

Criterion 4. The value of the commission or spread

Spread called the difference between the purchase and sale prices of currencies.In other words, we can say that this is the usual commission that brokers charge for the operation. Therefore, you should choose a brokerage company in which this percentage of the commission below.

The spread is deducted from the transaction amount immediately after the transaction is opened. At the same time, a person automatically has a small minus immediately. for exampleif upon closing the transaction the income was 50$, then it will return to the trading account 49$, $ 1 will go to the brokerage company.

Criterion 5. Features of the service

Before you begin to cooperate with a brokerage company, you should initially communicate with his staff and with the support service. You should also consider all possible ways to withdraw earned money.

Step number 3. Choose the necessary financial instrument

To begin to perform operations, you must first install the necessary trading platform. Each broker has its own differences in functional features and interface.

To carry out operations on Forex, most brokerage companies adhere to the classic program. Metatrader 4 or 5 versions.

After installing the program, you should review, analyze it and try all possible actions. In order not to poke your finger in the sky, you should find detailed instructions on the given trading platform on the Internet or request information from consultants of a brokerage firm.

Once the program has been fully studied, it should determine currency, which will actively act in the commission of the operation.

There are a lot of currency pairs on Forex. For instance, euro dollar, British Pound-Japanese Yen and others. It is best to start with the most popular currency pairs. The most common is euro dollar.

Once a currency pair is determined, it is worth observing its movement schedule and how often price changes occur.

When a trader has more experience, he can start trading immediately with several currency pairs.

Step number 4. We train on a DEMO account

A DEMO account should be opened for the amount that, if work continues, will be invested in real trading capital.

Training should be conducted for at least one week. This will allow you to accurately understand the technical characteristics of trade and most accurately understand a computer program.

Do not be frivolous about this training. It should be imagined that the exchange takes place on real saving. Therefore, it is worth not to allow the appearance of large losses and not to chase a very large income.

When making transactions, you should calmly relate to each completed transaction. It is necessary to open and close the operation with full confidence, claiming that this decision is the most correct.

Important!

It is not recommended to start trading for real money until a stable income appears on the DEMO account.

Quite often, people playing with virtual money gain a good income in a short time, and sometimes they can two three times increase the initial capital. But when it comes to real money, things are not going as smoothly. Here, a person begins to interfere emotions. It is the emotional state that is the main negative factor for making big money.

Creating and developing your own Forex trading strategy

Creating and developing your own Forex trading strategy

Step number 5. Develop your trading strategy

A DEMO account is opened not just to play, but to understand and develop some special trading strategy, which will bring a steady income.

A trading strategy is the rules by which opening and closing operations take place. In order to properly develop a strategy, you should decide on time intervalwhich is most suitable for trading.

Sometimes some traders make many transactions in one day, while others complete the transaction once a week or a month. Moreover, in both cases, the result can be the same.

The time intervals in the Forex market are usually divided into three varieties:

- Short-term trading. Also called another day trading. In this form, all operations occur during the day. At the same time, a person catches all the occurring price fluctuations throughout the day. For a day, he can open a large number of transactions and this will make it possible to get a good income. This species has a small disadvantage - one transaction brings only a small the amount and the person has a great passion in the trading process.

- Average daily trading. It takes from several days to one to two weeks to complete one operation. At the same time, the trader needs to carefully analyze the chart, as well as the general economic fund. To get a decent income, you must immediately open two or three transactions, each of which should be monitored and adjusted daily.

- Long term trading. The deal closes after a few weeks or after a couple of months. When choosing this type, you should definitely monitor the direction of the global trend. Also on the trading account must lie solid amount. Indeed, over such a long period of time, the price can fluctuate very much.

Also to right to develop a trading strategy, it is necessary to take as a basis technical and fundamental analysis. It is not necessary that the strategy be based on two analyzes at once. You can choose one of them.

- Technical analysis. In this case, you need to study price chart, figures and levelsthat are formed because of it.

- Fundamental analysis. In this case, you will have to carefully monitor economic situation in the world, explore the news background and the whole situation in a particular country, namely the one whose currency is used for transactions.

You should only proceed to the next steps if the trading strategy is fully developed and understood. In this case, the stability analysis should be taken into account at an interval of one month.

Step number 6. We open a real account

If the broker has an opening service cent account, then you should use it. Here you can learn to trade for small amounts and at the same time it will already be considered work for real money. If all the capital is lost, then there will be no pity for the money spent, but the person will get good experience.

After that, if there is a more serious amount of money, then you can already open dollar account. You don’t have to invest too much money right away. At first, it is recommended to trade on a small amount, and already over time, you can start opening accounts for large bets.

According to statistics almost all newcomers at the beginning of their activity lose more than one trading capital.

Take note!

Lose several times by 100$- 200$ will be less offensive than 1000$-5000$.

As a result, at this step, a person must fully determine the size of the invested trading capital and the opening of a real account on Forex.

Step number 7. We start trading with minimal loss or no loss at all

The main step in the work is the acquisition of skill and break-even trading. You should not try to earn a lot right away. The main task at this stage is transactions, risk control and avoidance of losses.

As soon as there is sufficient confidence that the account does not go negative for each completed transaction, you can begin the next step in the work.

Step number 8. We get the first profit

It is at this step that all the talent that a person has for working on exchange trading will affect.

First profit It is an exciting and memorable moment for every beginner. According to statistics forex market most people also quickly they lose her, as they earn.

A trader is called the one who consistently gets the result.It follows that the professional trader is the person who was able to increase his account not for two completed transactions, but who for several months or even years consistently makes a profit.

When a person already has a lot of completed transactions on his account, then all the obtained results of these operations should be analyzed. Also, in order to get a good result, you need to understand the reasons for the movement of the price of currencies.

Step number 9. We increase trade capital

If for a long time it turned out to constantly increase your account, but the amount of income was not very large, then to get more income you just need to increase trading capital.

To make a big profit you should think interest. For example, with $ 1000 per month, we managed to get 6-8%, then having put $ 2000 on the account, an increase in income should occur by the same percentage.

If everything works out further, then each time the score must be increased 2-3 times. After a certain time, you can gain confidence and make deals for larger amounts. This is exactly what a novice trader should strive for. Because the larger the amount, the more profit.

Forex trading should be taken very seriously, as if it were your own business. You can’t relate to work as a hobby. In this case, success will be impossible.

Step number 10. We come to a stable profit

If for a long time occurs breakeven trading and a well-thought-out strategy gives results, as well as control over emotions has appeared, it’s worth moving on to really serious work.

Any novice trader should understand that not all transactions will be profitable. Losses will also occur. The main thing is that as a result, the total income for the month exceeds several times the losses received.

Sometimes it may occur that the transaction with the loss of money is much more than the operations for profit. But still, in this case, the total profit should cover all losses.

For instance, 40 transactions were completed, of which 15 brought profit, and 25 losses. Suppose, on average, one transaction brings $ 50, then 15 transactions will bring 750$. With unprofitable operations, the loss was $ 10, that is, the total losses were 250$. As a result, the income is 500$. From this amount, a broker commission will also be deducted. As a result, on hand it turns out about 485$.

If you understand this strategy, you can be calm, even if for a long time loss-making operations are obtained.

How to make money on Forex - a personal example of earning + the basic rules of currency trading for a beginner

How to make money on Forex - a personal example of earning + the basic rules of currency trading for a beginner

6. A personal example of earning on Forex - the story of one trader + the rules of successful Forex trading

Many are interested in the example of personal Forex earnings. Here is one such story (one of the regular readers sent it to the editorial office of our magazine):

I only worked on Forex for a few months. I didn’t have a goal here to get a big income and become a professional trader. I’m just a very curious person and I wanted to check Is it possible to earn income here.

To begin with, as it should be, he began to study theory. I examined all Forex trading strategies and learned to trade on a demo account. In general, I completed all the steps described above From and To.

After that, I opened a trading account on real money in the amount of 1000$ and began to actively trade. (By the way, before starting trading, I read a useful article for beginners and novice traders on how to play on the Internet exchange and win). The worst thing is to open your very first deal, but oddly enough it was profitable.

On the first day I was able to earn 55$. Next day I am this amount completely lost. I would like to honestly admit that the transactions occurred without observing any particular system. I began to open all transactions intuitively and my emotions very much interfered.

A few days later I managed to get 500$ arrived. Which amounted to 50% of my initial capital. Moreover, there were a lot of risky situations in which I could lose up to 25% of my personal money.

4 Important Rules for Profitable Forex Trading

After such success, I decided to analyze all the transactions made and made the following conclusions for myself on how to make a profit on Forex or at least stay with my money.

Rule 1. Always control your emotions.

You should not open a deal without a clear idea of the situation, just giving in to your emotions.

If you always listen to your emotional state, then Forex activity can be compared to a game of roulette, where success is always followed by a big failure.

It is very important for a novice trader to fight his fear and greed, because they are the main enemies of all failures.

Rule 2. Trading must occur strictly according to the chosen strategy.

A fairly large amount of information about possible strategies can be found on the Internet or in special books.

Any trading strategy is drawn up depending on the psychological state of novice traders, and also takes into account how much time one transaction will take and with what currency pair it will happen.

Rule 3. Ability to manage risks

Do not invest a large amount of money in one operation.

Stop the transaction in time if the result is minus. You can place special orders that will forcefully close the deal if the result has reached the necessary profit or the level of acceptable loss.

If something didn’t go according to plan, then it’s worth right away close the operation, and not leave it open and wait for the result to be in a positive direction.

Rule 4. You must always learn and practice.

Any independent business requires development, therefore it is recommended to go to courses and trainings that talk about exchange trading, as well as buy and study literature on this topic.

You can still contact YouTube. There are a lot of good videos where they talk in detail about getting profitable trading.

Of course, it is best to find an experienced mentor. It is this person who will be able to immediately show all the mistakes that beginners make and then you can achieve success much faster.

I hope that all four of my rules are very useful for novice traders.

Now I want to talk about how I completed my work on the exchange. I gradually lost my profit and eventually returned to my original capital of $ 1000. On this I stopped and decided to withdraw my money back. That is, I did not make a profit and did not lose anything.

It turned out to be very difficult for me to conduct trading operations emotionally. Probably this area of activity is not suitable for me. But for myself, I realized that in the forex market people really make money. The main thing is to decide whether this area of activity is suitable for you.

P.S. You can also watch a video in which a trader shows a real example of his personal Forex earnings.

The Forex market is not the only place to make money. There are many other interesting ways to make money online. But if it is financial transactions that attract your attention, then you should definitely take a chance. It is then that you can understand for yourself whether you have the ability to this type of earnings.

Forex technical indicators are the necessary tools for any trader who wants to significantly improve trading indicators

Forex technical indicators are the necessary tools for any trader who wants to significantly improve trading indicators

7. Forex indicators - the main types of indicators + TOP-5 of the best tools of a modern trader 📏

To work effectively on Forex and get a stable income, there is no special way.But each transaction should have a thoughtful analysis of the available information that allows you to compile winning the situation. At the same time, the trader thinks through all the possible risks and makes an operation that will be most beneficial for him.

As already mentioned, the analysis on Forex occurs in two ways: technicaland fundamental. In addition, each of these species is based on certain indicators indicators.

Forex indicators - These are special software products that allow you to predict exchange rates through mathematical calculations with prices and volume.

Thanks to exchange indicators, you can determine the right solution for making a transaction on Forex.

At fundamental analysis statistics are used, and when technical - tools with which you can find occurring formations on the price chart.

The first the type of analysis has few indicators, and second - Includes a lot of tools, and because of so many novice traders are often lost in choice.

7.1. Indicator categories - 3 main groups

Before you begin to consider the most popular technical tools, you should understand that technical analysis, Unlike fundamental, draws conclusions depending on various types of observations. Therefore, they are usually divided into main groups. Each of them has its own pros and minuses.

Let us briefly consider each group of indicators:

- Trend indicators. It is best used for a transaction with a pronounced trend. (This is when the price chart goes up for a long time, and then also drops for a long time). They show the accuracy of the analysis and help determine the current direction of the trend. If chaotic movements appear on the market, then use this method Not recommended. Because such an indicator will show false signals and as a result, a trader will face big monetary losses.

- Oscillators These indicators are well suited for chaotic movements, when the price constantly falls or rises. This movement is usually called lateral. The disadvantage of this type is that the price can stop changing and for a long time either rise or fall.

- Volumes. They track changes in trading volumes at specified intervals, which allows you to calculate a favorable moment to enter a position in the market.

7.2. The most popular indicators in any financial market

TOP indicators on Forex include instruments from each main group, since they all have their advantages (+) and disadvantages (-).

Consider the top five best Forex indicators:

Indicator number 1. Moving averages

Trend indicator. Calculates the average price for a selected time period. When building, one line is used.

Moving Average (MA) - one of the most popular technical indicators

Moving Average (MA) - one of the most popular technical indicators

Indicator number 2. Bollinger Bands

It is also a trend indicator. This indicator is relevant only for long-term transactions.

Bollinger bands show the market volatility (volatility) based on the m / y distance of the upper and lower bands

Bollinger bands show the market volatility (volatility) based on the m / y distance of the upper and lower bands

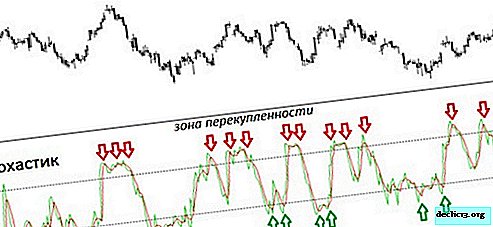

Indicator No. 3. Stochastic

Belong to the group of oscillators. This indicator is a good indicator of when the deal should be completed and when to open a new one. It can also indicate to the trader the areas in which the currency is greatly overestimated.

Stochastic Oscillator shows when the market is overbought and when it is oversold

Stochastic Oscillator shows when the market is overbought and when it is oversold

Indicator No. 4. Volumes

The simplest and most effective volume indicator. Tells what exactly the market makers are doing at the moment - they are buying or selling. And traders, as a rule, do what market makers do - egif they sell, then traders sell, and if they buy, then traders buy.

The Volumes indicator (volume indicator) is able to show whether a price breakthrough was true or false, because it takes into account the volume of transactions

The Volumes indicator (volume indicator) is able to show whether a price breakthrough was true or false, because it takes into account the volume of transactions

Indicator No. 5. MACD

It combines both a trend indicator and a central oscillator. This indicator helps with determining the direction of the price movement, makes it possible to understand the potential strength of this movement, and also with the help of it you can determine what is the probability of a trend reversal.

MACD (histograms and lines) enable the trader to enter the market at the beginning of a good trend and exit before it ends.

The construction of MACD charts (from the English Moving Average Convergence / Divergence - convergence / divergence of moving averages) occurs in 2 ways: 1) linear and 2) in the form of a histogram

The construction of MACD charts (from the English Moving Average Convergence / Divergence - convergence / divergence of moving averages) occurs in 2 ways: 1) linear and 2) in the form of a histogram

All tools included in the TOP indicators are almost finished trading systemwhich are used by almost all traders. Therefore, to start making stable income in the Forex market, you should carefully study one of the tools.

Now a lot of new tools have appeared, but they are all based on the classic versions of indicators.

Overview of the best trading systems (TS) and Forex strategy + 3 important criteria for choosing a suitable TS

Overview of the best trading systems (TS) and Forex strategy + 3 important criteria for choosing a suitable TS

8. Forex strategies - how to choose the right trading strategy + review of the TOP 15 best forex strategies for beginners and professional traders

This section will tell you about the most profitable strategies, with which trading system a beginner should start and what secret professional traders have for successful trading.

In the Internet lots of of various strategies and it is very difficult for a novice trader to make a choice. Let's try to figure out which ones are more suitable for each individual psychological type of trader.

8.1. What is a Forex strategy and why is it needed in trading

Suppose a person enters an unknown dark place. If the light does not turn on, then it will stumble on some thing or break something. When the light is on, you can simply walk around the room and find the necessary item.

Forex Strategy performs this role Sveta. With the help of it, the market is better known and a possible movement is predicted.

If you do not use the strategy, the trader will be in the dark and make mistakes, lose money and will not see the further development path. Therefore, it is worth deciding for yourself whether to move in the dark or still light your way. So what is a strategy?

Trading strategy - This is a developed system of rules that must be followed in sequence by a trader who wants to increase his income in the financial market.

It allows you to make all transactions without hesitation, and not randomly close and open operations. As a result, losing all capital.

Strategies can be compared to traffic lights. Where everyone knows what's on green should start a deal, on yellow - we we waitbut on red deal closes. In this case, the trader should not consider other options for exit.Professional traders adhere to such a principle, and newbies quite often neglected this.

Experts say:

It is quite simple to open a live account for a large amount, it is much more difficult to make a profitable transaction.

The chosen strategy allows you to save the trader from of permanent think it over. Opening a transaction occurs in a certain situation.

These include the following situations:

- When the indicators set on the chart intersect;

- When the price reaches the set value;

- When a candle shape or a candle combination appears on the chart;

- When a familiar shape forms on the chart, etc.

You can stick to ready-made strategies. If you have experience, then several strategies can combine together. Or, if you have the ability, develop your own strategywhich basically has many other rules. The most important thing is that she be with each trader.

Each strategy needs to be tested on demo account. On a real account, it can be used only after some time (after a positive trading result). Of course, if during this time the strategy showed profitable results.

Without a strategy, all trading capital will quickly move into zero.

At first glance, it may seem that working according to specific rules in the Forex market is quite simple. But statistics shows that 90% novice traders stop following their strategy and leave the market. However, they lose their opportunity to become a successful person. Only 10% traders become successful.

How to choose a forex strategy for a beginner

How to choose a forex strategy for a beginner

8.2. How to choose a forex trading strategy - 3 main criteria

If you decide to use a strategy, then you need to choose the most suitable. Indeed, on Forex there is a huge variety of trading strategies (TS) that bring good profit. How to choose a vehicle so that it fits all the necessary parameters?

Here is an example from real life:

Suppose, a person has a goal to buy a TV. He knows what it is intended for and about what it needs. To buy, he goes to a special consumer electronics store. And there is discovered a bunch of specific TV models. A person is faced with the task of choosing the right one. At the same time, the TV that he chooses is no worse than the remaining models. He just likes this option more and feels more comfortable with it.

In the Forex market, the same thing happens when choosing strategies. The trader understands that he needs profitable rules by which he can earn. The main task is to choose the best option. A person chooses the strategy that he likes best and that’s does not meanthat others are much worse.

Forex strategy should be chosen according to three criteria:

- How long the open position will be held;

- Market analysis approach;

- Graph analysis method.

Now let's talk in more detail about each of them.

Criterion number 1. Duration of keeping the deal open

Some people prefer marathonand others sprint. All strategies are also developed depending on the duration of transactions. Moreover, they are divided into short term, medium term and long term.

1) Short-term. Most use them experienced traders. After all, aggressive trade takes place here. Open daily from 10 transactions (there are cases when and more 100).

Short-term strategies are divided into two types:

- Scalping strategies. Should be chosen by traders for whom small capital. Each transaction can be opened. from 5 to 30 minutes. As a result, daily about 200 deals. But do not chase the quantity. Experienced investors believe that scalping - This is the most difficult approach to trade. After all, this strategy can be used regardless of the tendency of the price.

- Intraday. All operations open and close during the day. Strategy Data easy to understand for all and suitable for any beginner. You can open more than one deal per day and use different currency pairs. The average number of transactions per day is two to five.

2) Mid-term. For this strategy, you need to have excellent knowledge of technological analysis. The transaction may be in an open state. from 1 to 45 days.

3) Long-term. Such a strategy can be used both beginners and experienced investors. The transaction is open. up to several months. In this case, without any stress, a change in price is monitored and you can be calm over the ongoing state of an open operation. With these strategies, you can only enter the Forex market once a day.

If the correct forecast is developed, then the profit will be very good.

Criterion number 2. Market Analysis Approach

To make an accurate forecast of price changes, you should learn more about fundamental and technical analysis.

Beginning traders sometimes begin to master only one view, but this is not enough. If you want to make a profit, then you need to study everything.

At fundamental analysis Price forecasting is carried out, which is based on world news and depending on the global economic situation.

Why keep up with the news? The important news regarding the economic situation in the country or even in the world can dramatically affect the price change, for which almost any strategy not ready.

All news is usually divided into three types:

- Most important;

- Important;

- Minor.

At the same time, the basic rule of professional investors should be adhered to: never start trading if publishedimportant news. Because if a stop order is set, then it will work almost immediately. Here it is best to close positions as quickly as possible.

At technical analysis the whole market is being analyzed according to the price chart.

Here, all forecasts are made depending on the previous movement of the price change. To compile an analysis, you must use indicatorsas well as the price chart and its elements.

Forex technical analysis is best used for short term operations if the market is calm.

Criterion number 3. Graph Analysis Method

There are three main methods for predicting technical analysis.

Method 1. According to the figures

It is assumed here visually detect figures that are formed on the price chart and know exactly how the price will react after this situation. There is exact knowledge by which the price is formed. Each trader must learn them by heart.

Exist two groups of figures that are established in the Forex market.

1) Figures that subsequently predict a reversal in the price chart:

- Head and shoulders;

- Inverted head and shoulders;

- Diamond;

- Double base;

- Double top;

- Triple base.

2) Figures that predict the duration of the trend:

- Triangle;

- Flag;

- Pennant;

- Wedge;

- Rectangle.

Method 2. By indicators

Using this method, various technical indicators are set on the chart that tell the trader when to make purchase or of salesat. Do not use a large number of indicators. It won’t bring profit. You need to choose only a few options that are most understandable and suitable for a particular situation.

Professional traders usually use 2-3 indicators.

As mentioned above, indicators are divided into trending, oscillators and volumetric. But not one famous and accurate indicator will not be able to provide the exact direction of the transaction. When using them, you must adhere to two basic rules:

- The maximum profit will be only when all the indicators used give a signal about the same action.

- Indicators cannot take into account price behavior when important news is released.

Method 3. Candlelight

Candlestick analysis is the most simple and straightforward. Candle represented by the body, white or black, and also has shadows. The body has the shape of a rectangle, large or small. Shadows are thin lines that are located on both small sides of a rectangle.

Candle borders Opening and closing prices are indicated. Line ends - these are the minimum and maximum values set in a certain period of time.

There are candles bearish (closing cost less than opening cost) and bullish (closing cost is greater than opening cost). Bear candles are black in color, and bullish candles are presented in white.

If the bottom shadow is very long, then this is a signal to start bull market. If the long upper shadow, then this indicates the beginning bear market.

Usually such candles are called Japanese. There are so many candlestick patterns. If you study each of them, then finding a familiar combination, you can easily conduct trading on the currency exchange.

for example, there is a shooting star model. It is a small rectangle with a long upper shadow and a small bottom. Such a candle indicates that you need to start selling.

8.3. Profitable Forex Trading Strategies - 15 Best

Consider the most profitable strategies. They can even figure them out novice trader. Each of the strategies can be used for short and intraday deals.

Strategy number 1. Moving averages

The strategy can be used with any currency pairs. The work takes place in two time intervals: weekly (W1) and four hour (H4) . In Forex they are called time frames.

A weekly chart allows you to determine the trend, and four-hour charts allow you to open a deal at the right time and determine the exit point.

So, we launch the Metatrader 4 trading program, set both timeframes on the zone for trading. In this case, it is better to use the EUR / USD currency pair.

On weekly W1 two moving graphics are made. To do this, open the "Insert" tab in the main menu, then "Indicators / Trends / Moving Average".

Values first exponential moving (Ema) install the following:

- Period - 21;

- Construction Method - Exponential;

- Apply to - the average price in the market.

Values for second plain moving (SMA):

- Period - 5;

- Construction Method - Simple;

- Apply to - the average price in the market.

If the price chart is above the two moving averages, then the trend is ascending, and vice versa.

Weekly: SMA 5 crossed the EMA 21 Moving Average - the trend is downtrend

Weekly: SMA 5 crossed the EMA 21 Moving Average - the trend is downtrend

After determining the trend, go to four-hour H4 schedule. It also houses two simple sliding ones.

For moving SMA1install:

- Period - 55;

- Construction Method - Simple;

- Apply to - Median Price.

For moving SMA2:

- Period - 7;

- Method - Simple;

- Apply to - Closing the candle.

4-hour chart: If SMA 7 crossed SMA 55 from top to bottom, then a sell order and vice versa. We place a pending buy order at the level of SMA 55

4-hour chart: If SMA 7 crossed SMA 55 from top to bottom, then a sell order and vice versa. We place a pending buy order at the level of SMA 55

As soon as all the tools and parameters are set on the price chart, we begin to follow the trading signals for opening a transaction, after its completion we strictly observe the rules for exiting this position.

The main thing to remember, what if weekly the chart has an uptrend then on a timeframe H4 we only consider signals on purchase.

This strategy has two ways to enter the market:

- When SMA2 crosses SMA1 top to bottom, you need to place a pending buy order on the line SMA1 .

If the price value continues to move, then the pending order should be dragged along the line of the moving average until the price opens it.Pending order - this is such a function (or opportunity) provided by the Forex broker that allows you to set on the chart automatic opening a position at any selected price level at the moment when the current market price reaches this level.

- When SMA2 crosses SMA1 from the bottom up and the candle will fix on top of this intersection, you should open an order for the acquisition currencies.

For both entry methods, stop loss located on local extreme points (preliminary maximum or minimum values).

To set the value take profit for this strategy, you need to attach to SMA1 certain lines. To arrange these lines you must use Fibonacci number sequence. Just open properties SMA1, in the tab "Levels" and set the necessary values:

- 144 (points from SMA1, will be located above it), -144 (will be located under the moving average);

- 233, -233;

- 377, -377.

If the trend ascending, and a signal appears to open a position for purchasing currency, we start three operations with the same lots, all stop-losses are located at the local minimum value, and take profits:

- For the first position on a straight line 144;

- For the second - at the level of 233;

- For the third - at 377.

Similar actions for opening and tracking positions are used for sales orders.

Strategy number 2. London session

The easiest strategy, as a result of which the trader gets to arrive or remains at his initial capital. The probability of a loss is very small, but there will always be risks in the financial markets.

Start a deal at 10 am by Moscow time. It was at this time that the London Stock Exchange opened. For trading, it is best to use a pair in which there is British pound (GBP).

Ruleset: The strategy involves daily entry into the market, but only once a day.

We open the chart of the currency pair we like for the last three hours. Set two horizontal lines that will pass through the most low and the most high the price for a given period of time.

After the opening of the London session, we observe in which direction the price will go. If it breaks the upper line, then we open a buy operation, if it overcomes the bottom line, then we sell.

In the first case, the stop loss is located on the bottom line, and in the second on the top. Take profit in any case is set one and a half times more than stop loss.

We have a pending order to buy or sell with a margin of 5 points from a particular line.

If the position does not work, then close it after 2-2.5 hours.

Strategy number 3. Three candles

This strategy is great for scalping. You can use any currency pair. The timeframe is set as desired.

Ruleset: With this strategy, we wait for the appearance of two approximately identical candles that go in the same direction. It is very good if they do not have long shadows. As soon as appears the third candle, open a deal.

To secure, use the Stochastic indicator. If the direction of the stochastic lines is contrary to the deal - skip the signal. If candles 1 and 2 are visually small, then entering is not recommended. If the second candlestick is very large (it stands out on the chart), skip the signal.

Stop loss should be set above or below the first candle. Take profit can be set at the discretion of the trader. Or we leave after the first profitable candle.

Strategy number 4. Simple

Strategy for people who love risk. All transactions are made behind 1 a minute. For instancetake a currency pairGBP / JPYand use on the price chart Bollinger Lineson which the following values are set:

- period 50, Deviation 2 (Line 1);

- period 50, Deviation 3 (Line 2);

- period 50, Deviation 4 (Line 3).

Ruleset: Trading should be done when the London session opens and the Japanese ends. It is not recommended to perform operations when news appears.

Buying should begin when the price chart falls between 1 and 2 lines. If a mirror situation appears, then it is worth making a sale.

Stop loss can be set any, but no more 3%.

Strategy number 5. Quick profit

This strategy is very effective for scalping, while it is quite simple. You can use any currency pair. All activities are underway. on minute timeframe.

The following indicators are used for this strategy:

- exponential moving averages (EMA),

- Parabolic SAR;

- MACD

On Ema periods 25, 50 and 100 are entered. Standard values are made on other instruments.

Ruleset: A deal should be started when the price chart crosses all moving averages. Two other indicators will determine in which direction the auction will be held.

If the price chart rises from the bottom up, crossing all three EMAs, the Parabolic SAR remains below it, and the MACD rises up, then purchase.

Take profit has maximum value 10 points, because after that there is a high probability of price changes. After the price moves away from the started transaction, you should put the position onbreakeven state. To do this, the stop loss is located at the previous local minimum or maximum values.

Strategy number 6. Juicer

For this strategy is used day interval D1. You can use any currency pair.

Ruleset: Rules for Transactions to purchase:

- After a candle with a black body, two little white candles should form in a row.

- The completion price of the second little candle is higher than the maximum value of the first little candle.

- At a distance of 5 points greater than the maximum of the second little white candle, a pending order is placed.

- Stop-loss is located at the minimum of the second little white candle, but not more than 80 points and not less than 45.

- Take profit is 500 points.

- If, at the close of the fourth day after entering a trade, the price is in the positive zone, it should be transferred to breakeven. If the price is in the negative zone, then the transaction is completed at the market price.

- When 200 points of income have already been received, a trailing stop of 200 points and a step of 50 points is set.

Rules for Transactions for sale performed similarly, only the first paragraph will be like this:

- After closing the candle with a little white body, two consecutive black candles should form.

- further according to the above rules.

Strategy number 7. Outsourcing

Activities underway on 15minute chart M15 with the GBP / USD currency pair.

In order to obtain a high probability of success from this strategy, it is necessary to fulfill all points precisely.

Ruleset: First you need to set the exponential moving average with a period on the fifteen-minute chart in the Metatrader 4 trading terminal 9 (EMA). Next, you need to wait for the following situations:

- neither the body nor the shadow of the last candle should touch the EMA;

- the ideal option is the moment when the maximum or minimum values are located at a distance of approximately one point from the moving average;

- it is required that the closing price of the candle be greater than the previous maximum (if currency will be purchased), or the minimum (if a sale is taking place).

If appropriate situations arise, you can start a deal to buy if the candle is located above EMA, or for sale - if below.

Stop loss is placed at the minimum value of the previous candle. Take profit equals the number of points of the previous candle.

If during the transaction the price quickly went in the direction we needed and passed 20 or more points, then we transfer the operation to breakeven.

It is not recommended to use this strategy with a lateral and calm price direction.

Strategy number 8. Channels and Envelopes

The strategy is intended for the H1 trading timeframe (hourly chart). The currency pair should be used EUR / USD. For the implementation of transactions required 2 tool: Envelopes and Bollinger bands.

Envelopes Values:

- Period - 288;

- Shift - 1;

- Method MA - Exp;

- Apply to - Close;

- Deviation - 0.15%.

Values of Bollinger Bands:

- Period - 24;

- Shift - 0;

- Deviations - 2;

- Apply To - Close.

Ruleset: A buy transaction is made if the candle crosses the blue line of Envelopes and closes above it. It is best that this coincides with the beginning of a new hour.

Stop loss is placed on the bottom red line, while it should be no more than 50 points.

When the price goes 40 points in the revenue direction, it is necessary to transfer the operation to breakeven.

Strategy number 9. Sniper

All work will be done. at 5 and 15 minutes schedule. Transactions can be made with any currency pair.All activities in this strategy based on levels.

Ruleset: An order is opened only if there is a rebound or a breakdown of the level. If we learn about significant news, then 20 minutes before their appearance, orders are not placed. Daily Not recommended gain more than 40 points. After increasing this maximum, trading should be stopped.

This strategy has three options for opening a deal:

- We begin the opening after breaking through, when the price is fixed on a pulse value or a pullback;

- We begin the discovery after a false break, when the pullback goes to the impulse value;

- We start the opening when the price exits the trading channel.

Entry We carry out two orders having equal lots. The first order has a take profit of 15 values. For another order, take profit is set to the near total impulse value. Such settings are commonly called levels support or resistance.

Strategy number 10. Exact entrance

A currency pair can be selected at the discretion of the trader. They like to apply this strategy. professional investors.